Although market forecasting is tricky business, we begin 2024 with our predictions. Each year, the RKL Investment Team holds our annual Market Outlook Summit to debate our “base-case” view for the following year. Establishing our base-case outlook is important because it helps inform any adjustments to our portfolio risk management framework for the coming year. The purpose of the exercise has more to do with adjusting asset class ranges around a target than with taking “all-or-nothing” bets. In each section below, we talk briefly about how our base-case outlook could affect client portfolio positioning.

Equities Market

Last year was a great year for “risk” asset classes. The global stock Index, The MSCI All Country World Index (ACWI),was up 22.8% YTD, having recovered from the lows of the 2022 sell-off, but still not surpassing the 2021 highs. In general, the U.S. was the top-performing equity market. U.S. large-cap stocks (S&P 500 Index) returned 26.3%, with U.S. mid-cap stocks (S&P 400 Mid Cap Index) returning over 16%. U.S. Small Cap (S&P 600 Small Cap Index) stocks lagged in performance but still returned over 15%. In global markets, international developed markets outperformed emerging markets by 8%. The MSIC EAFE Index (developed international stocks) returned 18.9%, and MSCI Emerging Markets posted a 10.1% return.

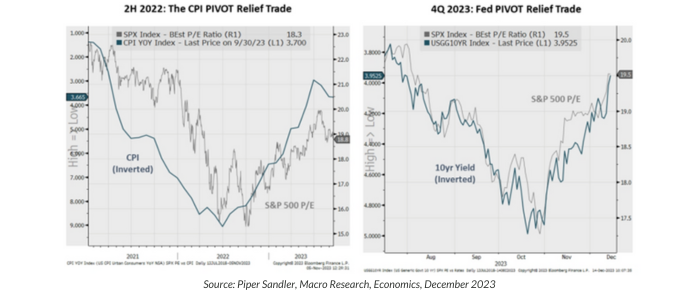

Coming out of the 2020 COVID-19 pandemic, we saw inflation begin to accelerate in 1Q 2021, and it continued to climb through 2022, with U.S. CPI Headline YoY hitting 9.1% by June 2022. To combat the multidecade spike in inflation, the Federal Reserve began to hike interest rates from 0.25% to 5.5% over a 21-month period. These two macro headwinds caused a significant sell off in 2022, with the S&P 500 Index (U.S. large-cap stocks) falling -18%. Looking back on 2023, equities responded positively to the prospect of both major macro risks – inflation and interest risk – peaking.

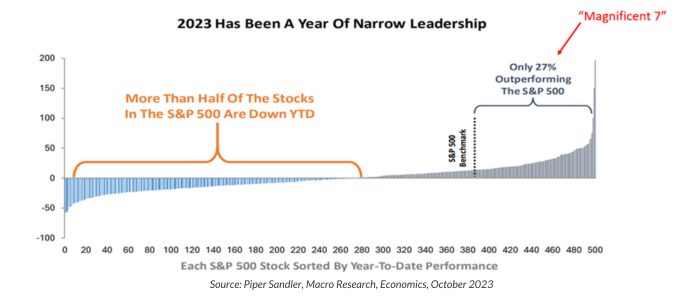

The 2023 rally in stocks was not without volatility. Throughout the year, we saw multiple market pullbacks until we entered the fourth quarter. Additionally, the stock market rally was extremely concentrated, where only a small selection of stocks within the S&P 500 Index drove most of the YTD returns (Magnificent Seven: Apple, Microsoft, Amazon, Nvidia, Alphabet, Tesla and Meta Platforms). When you take a deep dive into the underlying index, you can clearly see that most of the stocks returned less than the over Index.

Going into 2024, if we continue to see this rally hold and recapture all-time highs 1/3/22 (4796), we expect that the market “breadth” should improve. We should see other stocks that have not participated in the rally “catch up” in terms of performance. One of the ways we are watching, if this were to occur, is for the equal weight S&P 500 Index to finally “break out.”

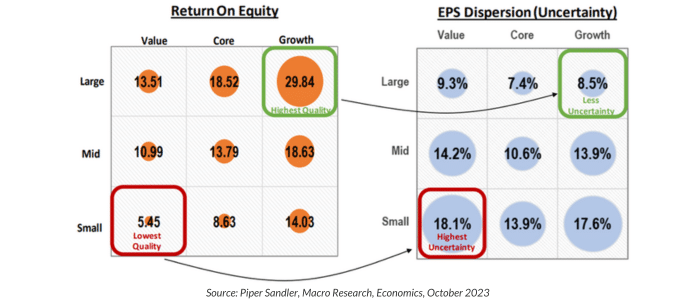

Our house view, however, is that we will still see a U.S. recession in 2024. Under that scenario, a recession is normally the catalyst that ends the bull market rally. Again, as we stated throughout 2023, we are not anticipating a recession like what we experienced in the Great Financial Crisis of 2007 – 2008, but we do expect U.S. GDP to come in slightly negative (around -1%) for 2024. Therefore, we still want to remain overweight in stocks, like we did in 2023, that have stronger fundamentals vs. lower quality stocks.

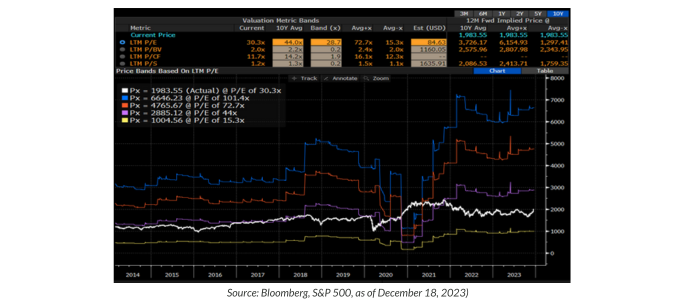

Finally, an era of the market that we find interesting, either coming out of a U.S. recession or even if this bull market continues, is U.S. small-cap stocks. Even though most U.S. equity asset classes experienced gains in 2023, performance has been bifurcated. For most of the year, U.S. large-cap stock experienced the biggest gains in terms of magnitude. However, from a valuation perspective, we find U.S. small-cap stocks interesting from a long-term allocation and mean-revision trade.

Fixed-Income Market

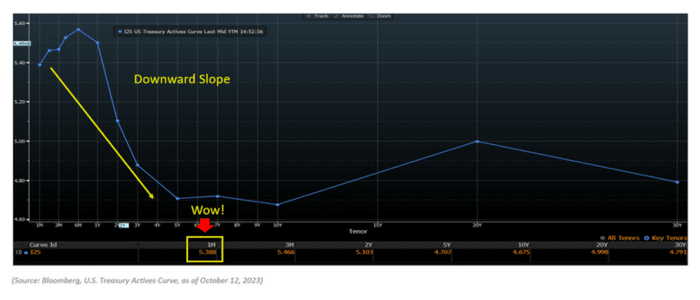

Since the Federal Reserve began raising the Fed Funds Rate target in March 2022, the Fixed-Income landscape has changed a lot. Prior to the Fed Funds rate lift-off, interest rates were both “low” across the different bond maturities, and the bond curve was upward sloping (meaning as an investor bought longer-dated bonds, they required more interest compensation). Throughout 2023, as the Federal Reserve hiked rates to combat multi-decade high inflation, the U.S. Treasury Yield Curve remained inverted, with short-term interest rates higher than long-term rates.

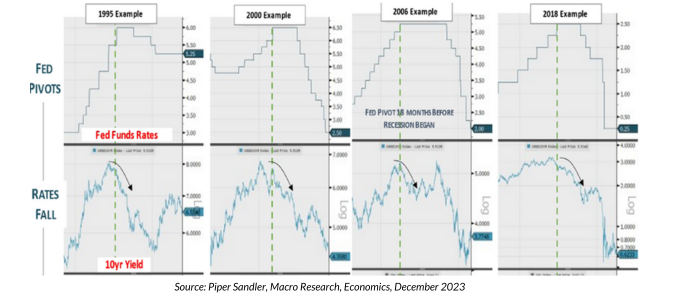

In 2023, given the rising interest rate backdrop, we positioned client bond portfolios to have lower interest rate sensitivity (effective duration) compared to our benchmark. Going into 2024, we are expecting the Fed to be closer to achieving their terminal Fed Funds rate for this cycle, compared to pushing rates higher by 100bps or more. Based on the history of past rate hike cycles, we want to begin to “walk out” our bond maturity profile (when we have bonds that mature into cash). History shows that in most cases when the Federal Reserve stops to raise interest rates, we tend to see lower bond yields across the short-intermediate bond maturities.

Overall, RKL Private Wealth’s Investment Team is still expecting 2024 to be a challenging year for both equity and fixed-income markets. We expect markets will still be dealing with multiple macroeconomic challenges, including inflation worries and the potential for a U.S. economic recession. However, just like in 2023, markets do have the ability to “climb the wall of worry” and continue to press higher.

The key to dealing with these uncertain paths forward is understanding that we buy stocks and bonds for the long run despite any forecasted near-term negative volatility. We do not recommend selling long-term stock allocations; however, as we noted above, we want to continue to position client portfolios to be more “defensive” within each asset class.

The views and opinions expressed are for informational and educational purposes only as of the date of writing and may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific person. All investments carry a certain degree of risk and there is no assurance that an investment will provide positive performance over any period of time. The information and data contained herein was obtained from sources we believe to be reliable but it has not been independently verified. Past performance is no guarantee of future results

Investment advisory services offered through RKL Wealth Management LLC. Consulting and tax services offered through RKL LLP. RKL Wealth Management LLC is a subsidiary of RKL LLP.