The Federal Reserve has begun to cut overnight interest rates despite inflation remaining above their two percent target. While lower short-term rates could provide a tailwind for the economy and stocks, market forces generally dictate longer-dated yields with the Federal Reserve having limited tools to influence them. With valuations well above historical trends in anticipation of lower interest rates, investors should consider a scenario where rates do not fall significantly in 2025.

There is a growing concern that elevated 10-year yields, specifically those at 5% or above, may imply the Fed has overcut in the face of ongoing inflation. This would likely be a headwind to stocks, especially if longer dated rates stayed over five percent for a significant period.

2023 and 2024 were exceptional years for U.S. Large Cap Stocks with returns over 20%. This strong performance came despite more than two years of inversion in the U.S. Treasury yield curve, which has historically been a reliable predictor of recessions.

If the prevailing rate environment is indicative of a “regime change,” it could have significant impacts on various sectors. For consumers, increased short-term rates would lead to higher costs for credit cards and auto loans. The rise in longer-term yields would result in higher mortgage rates, making home purchases more expensive and accessing equity from home price appreciation costlier.

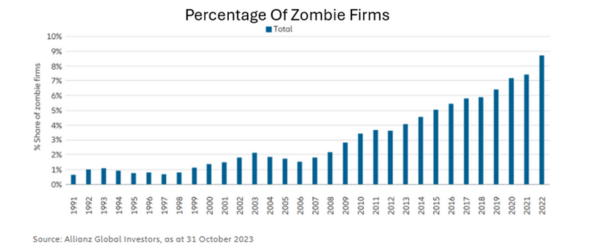

Moreover, higher interest rates would put pressure on “zombie companies,” those that only make enough money to service their debt but not enough to pay off principal or generate profits. An increase in interest rates could result in more such firms going out of business as lending standards tighten and reissuing maturing debt becomes costlier.

Perhaps the Federal Government would be most impacted by a higher interest rate regime. If the cost of issuing new and reissuing maturing debts rises unexpectedly, interest payments could become an increasingly large percentage of the budget. In fiscal 2024, servicing the national debt cost $1.1 trillion, more than total defense spending and approximately 40% more than the Medicaid budget. Such an unexpected addition to Federal outlays could require austerity measures like a commitment to reduce spending and raise taxes.

The base case remains that rates will continue to trend lower over time as the Federal Reserve reaches their two percent inflation target. However, it is crucial to monitor incoming data for potential risks of rates moving further upward or remaining higher for longer before coming down.

Investment advisory services offered through RKL Wealth Management LLC. Consulting and tax services offered through RKL LLP. RKL Wealth Management LLC is a subsidiary of RKL LLP.