Has your organization received letters from the Pennsylvania Treasury requesting remittal of unclaimed property? Since changes to the Commonwealth’s Unclaimed Property Act took effect in September 2016, state officials have been even more proactive about tracking down and collecting dormant or lost assets like uncashed checks, unused gift cards and the contents of abandoned safe deposit boxes. The 2016 law also increased the amount of fees and penalties the State Treasurer may assess on holders of unclaimed property who fail to report and remit.

The RKL team is experienced in helping companies and organizations comply with Pennsylvania’s Unclaimed Property Act. Contact your RKL advisor with any questions and check out this primer on unclaimed property and best practices for holder compliance.

How does property become unclaimed in the first place?

Under the Unclaimed Property Act, financial assets or certain tangible items are considered dormant after three years, with certain exceptions (such as payroll with a two-year dormancy) that can be viewed on Pennsylvania’s Dormancy Matrix. After the property becomes dormant and efforts to contact the proper owner have yielded no results, the holders must remit the property to the state, which will then hold the funds or assets as it undertakes additional location and reunification efforts. Unclaimed property laws, which have their roots in feudal times, are based on the idea that the state is a perpetual entity with more resources to find the rightful owners.

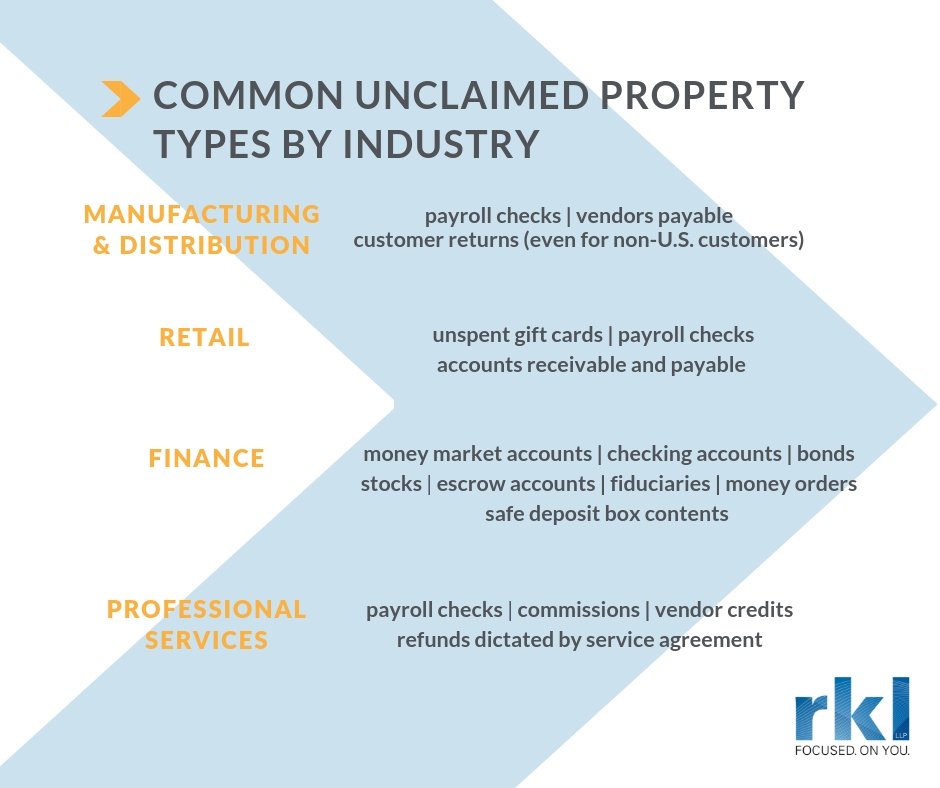

What is considered unclaimed property in my business or industry?

Unclaimed property can affect nearly every business, but below is a breakdown of common property types for key industries. This is not an all-inclusive list, so be sure to review the PA Dormancy Matrix for a full list of reportable unclaimed property types and their dormancy periods.

Gift cards may turn into unclaimed property, too

Retailers and businesses that issue gift cards to Pennsylvania consumers must be aware of potential liability under the Unclaimed Property Act. In Pennsylvania, gift cards are considered abandoned and unclaimed if not redeemed more than two years after the expiration date or five years from the date of issuance if no expiration date is listed. Keep in mind, the statute excludes from this treatment “qualified gift certificates,” which are defined as a gift certificate or card without:

- An expiration date or time period

- Any type of post-sale charge or fee (i.e. service charges, dormancy fees, maintenance fees, cash out fees or replacement and activation fees.)

How to respond to an unclaimed property letter

If you receive a letter about unclaimed property held by your organization and you have never reported before, the state offers a path to compliance. Entering Pennsylvania’s Voluntary Compliance Program allows holders to come forward and identify unreported or underreported unclaimed property from previous years and avoid any penalties or interest payments.

To apply for this program, holders must submit a completed Voluntary Disclosure Agreement (VDA). The VDA is not an option for holders who are already under an unclaimed property audit or filed a VDA within the prior decade for the same property type. Your RKL advisor can assist you with assessing the amount of reportable property and completing the VDA.

Tips for ongoing holder compliance

- Do the required due diligence: Pennsylvania requires all holders to send notice by either first class mail or electronically for items worth $50 or more. Holders must send the due diligence letters no more than 120 days and no less than 60 before filing a report of the unclaimed property. The September 2016 law specified certain details that must be included in such outreach: property description, property ownership description, property value and contact information of the holder. Remember, unclaimed property reports are due each year by April 15. Negative reports are not required but recommended.

- Watch for activity triggers and dormancy periods: Holders may choose to report unclaimed property in as little as a year, but they must do so no later than the dormancy period for the property type (often two or three years). The dormancy clock starts running when the property owner is considered lost, which is the date of last communication or expression of interest. The dormancy clock restarts upon owner action or contact (i.e. account deposit or inquiry made to holder).

- Be proactive about customer outreach: While holders are required to send due diligence notices right before unclaimed property is remitted, regular communication with customers or vendors can help prevent dormancy from ever kicking in and also helps to maintain accurate contact information.

For more assistance on managing your organization’s unclaimed property reporting responsibilities, contact your RKL advisor or one of our local offices today.