The historic $2 trillion Coronavirus Aid, Relief and Economic Security Act, (CARES Act) was signed into law on March 27, 2020, and includes a number of significant tax provisions intended to provide economic relief and stimulus to those impacted by the COVID-19 pandemic. Below, we discuss some of the key CARES Act provisions that impact business taxpayers, and highlight tax planning strategies to help navigate these uncertain times.

Increased Limitation on Business Interest Expense

The previously enacted Tax Cuts and Jobs Act (TCJA) limited the deduction for business interest expense to 30 percent of the taxpayer’s adjusted taxable income (ATI) for the tax year. The CARES Act increases the ATI limitation from 30 to 50 percent for taxable years beginning in 2019 and 2020 for C corporations and S corporations. The 50 percent limitation is only applicable to 2020 for partnerships. In addition, for any taxable year beginning in 2020, an election may be made to use 2019 ATI in lieu of 2020 ATI.

- Tax implications: The increased ATI limitation from 30 to 50 percent allows taxpayers to deduct more business interest beginning in 2019 (except for partnerships) and 2020. As many companies will probably have substantially lower ATI in 2020 compared to 2019, using 2019 ATI to calculate the 2020 interest expense limitation will allow taxpayers to deduct more interest expense for the taxable year 2020.

- Planning opportunities: In order to maximize the interest expense deduction in 2020, it may be advantageous to shift deductions, via accounting method changes, to 2020 in order to increase ATI in 2019. It is worth noting that this provision is elective for taxpayers to balance tradeoffs among tax planning options and various international tax provisions.

Net Operating Losses (NOL) Carrybacks and Limitation Relaxation

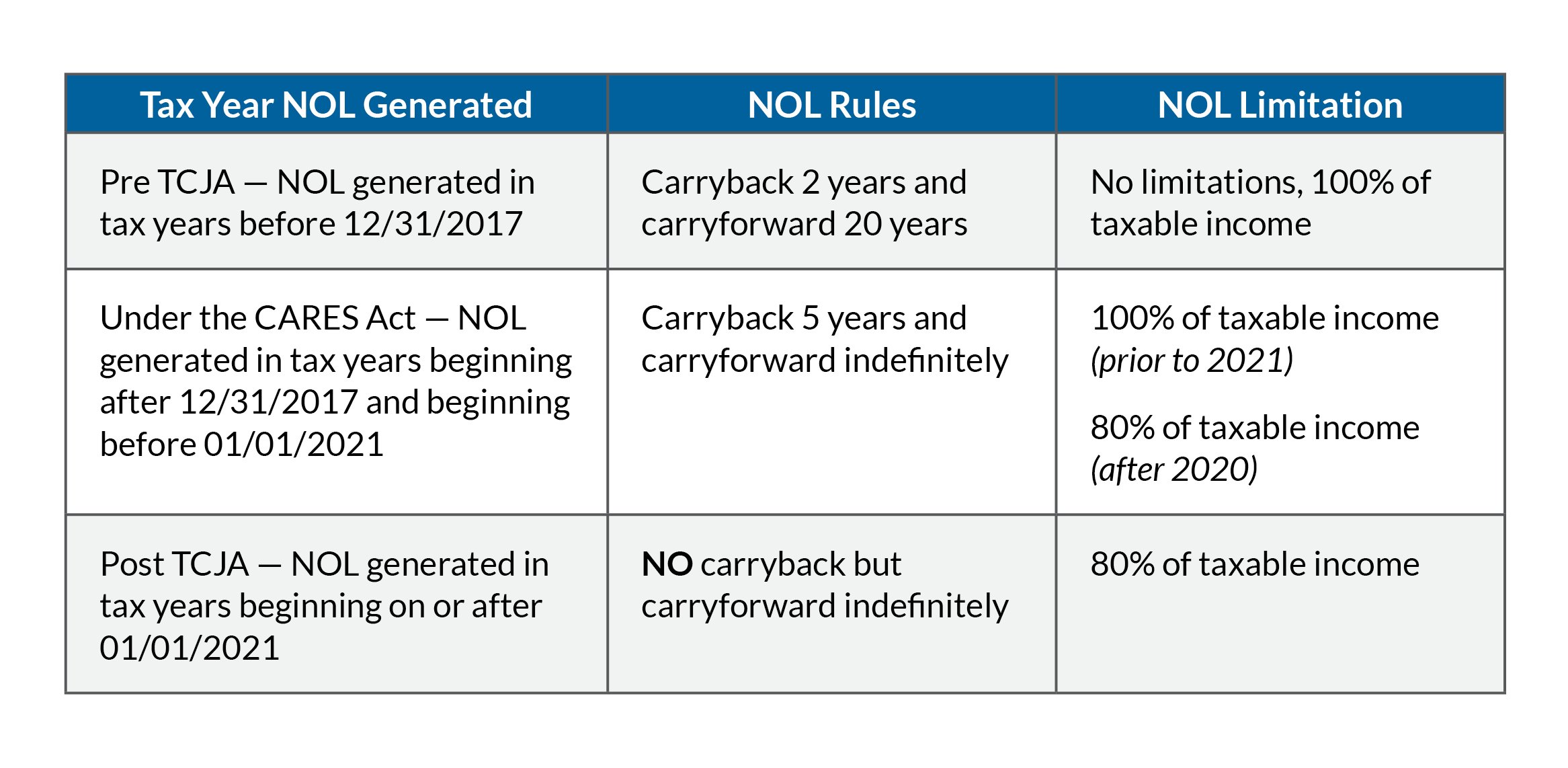

Under the TCJA, the ability to carry back a net operating loss (NOL) arising in tax years beginning after December 31, 2017 was eliminated. In addition, an NOL carryover can only be used to offset 80 percent of current taxable income. The CARES Act lifts the carryback and taxable income restrictions for NOLs generated in tax years beginning after December 31, 2017 and before January 1, 2021 (i.e. 2018, 2019 and 2020 losses) permitting a five-year carryback of NOLs arising in those tax years. The CARES Act also temporarily eliminates the 80 percent limitation, reinstating it for tax years beginning after 2020. Therefore, corporate taxpayers are allowed to use NOLs to fully offset taxable income as far back as tax year 2013.

As a result of the CARES Act, different rules will apply to NOLs based on which year they are generated, as seen below:

- Tax implications: This provision creates a significant opportunity to help companies improve their cash position. For example, companies that incurred or will incur a loss in any of the 2018 -2020 years but were profitable in prior years, can carryback NOLs to claim tax refunds. Another potential opportunity for additional cash tax savings as a result of this carryback provision is tax rate arbitrage, which means using losses incurred at a 21 percent rate against tax liabilities at a 35 percent rate in pre-TCJA years.

- Planning opportunities: Your RKL advisor can determine if there are accounting method changes that can be filed to create additional losses that may be carried back to the applicable years. Be mindful that for some taxpayers, the carryback of an NOL to earlier tax years can require a recalculation of various other tax attributes and deductions, such as the Sec. 199 DPAD, the global intangible low-taxed income (GILTI), foreign-derived intangible income (FDII), section 250 deduction, BEAT, foreign tax credits, AMT credits and R&D credits.

Acceleration of Corporate AMT Credits

The TCJA repealed the corporate alternative minimum tax (AMT) for taxable years beginning after December 31, 2017, and allowed taxpayers to claim incremental portions of refundable minimum tax credits (MTCs) over taxable years beginning in 2018 through 2021. The CARES Act accelerates monetization of the remaining MTCs and allows an additional 50 percent credit for 2018 (50 percent was previously allowed) or a 100 percent credit of the remaining balance for 2019.

- Tax implications: An accelerated timeline to claim refundable AMT credits allows eligible corporations to obtain cash tax benefits as quickly as possible.

- Planning opportunities: Rather than filing an amended 2018 return to claim the credits, the CARES Act allows the taxpayer to file an application for a tentative refund (quickie refund) by December 31, 2020 to claim its remaining MTCs for its 2018 tax year. This form can be filed immediately to accelerate the refund. Alternatively, the taxpayer can claim its remaining MTCs on its 2019 return. For taxpayers that have already filed their 2019 return, they may be able to file a “superseded return” to claim the unclaimed MTCs if such return is filed prior to the return’s extended due date.

Qualified Improvement Property (QIP) Technical Correction

An error in the drafting of the final TCJA legislation omitted qualified improvement property (QIP) from the list of assets that qualify for bonus depreciation, and required QIP to be depreciated over 39 years. Because only property with a depreciation recovery period of 20 years or less is eligible for 100 percent bonus depreciation, QIP was not eligible for bonus depreciation due to this error. The CARES Act adopts a technical correction to the TCJA and updates the recovery period of QIP to 15 years, which makes this property eligible for 100 percent bonus depreciation through December 31, 2022.

- Tax implications: This change is treated as though it had been written correctly in the TCJA (i.e., effective for property placed in service after September 27, 2017).

- Planning opportunities: If the 2019 tax return has not been filed yet, taxpayers can file an automatic accounting method change to claim this enhanced deduction. The IRS is expected to issue further procedural guidance regarding how to implement this change retroactively. Additional modeling and analysis will likely be beneficial to understand the interplay of this provision with the NOL provisions. Cost segregation studies may be advantageous to maximize deductions.

Employer Payroll Tax Deferral

In order to provide businesses and self-employed individuals with additional cash flow in 2020, the CARES Act allows employers to defer payment of the employer share of the social security tax (6.2 percent) due in 2020. Fifty percent of the deferred payroll taxes are due on December 31, 2021, and the remaining 50 percent are due on December 31, 2022. Taxpayers of any size may take advantage of this provision, and should contact their payroll tax provider to initiate a deferral.

- Tax implications: This deferral provision is not applicable for taxpayers that have already received indebtedness forgiveness under the Paycheck Protection Program (PPP).

State and Local Tax Complexity

The CARES Act adds another layer of complexity to state legislative tracking since the TCJA’s enactment. States generally conform to the federal tax code on either a static or rolling basis. For example, some states automatically incorporate changes to federal tax law, only decoupling from specific provisions, while others use a fixed Internal Revenue Code conformity date. Additionally, many states use federal taxable income as a starting point and require NOLs to be added back. Some states may require the calculation of interest expense limitations under their own rules. Moreover, some provisions of the CARES Act apply retroactively for federal tax purposes, but may not apply at the state level.

When a federal return is amended, states generally require a taxpayer to file amended returns as well. When deciding whether to file the federal amended returns for NOL utilization or other benefits, taxpayers should also take into consideration of potential state amended filings responsibilities. Failure to file a state amended return in several states allows the statute to remain open for the applicable year indefinitely.

- Tax implications: Taxpayers will need to monitor and analyze the state implications of the federal provisions they choose to take advantage of closely. In addition, the significant expansion of teleworking due to COVID-19 could potentially trigger nexus and additional filing obligations for taxpayers.

Income Tax Accounting

Under U.S. GAAP, companies must include the effects of any tax law changes in the financial statements in the period of enactment (March 27, 2020). A number of items included in the CARES Act have tax accounting implications, including changes to deferred taxes, valuation allowances and balance sheet classification.

- Tax implications: With the downturn in profitability that many companies will experience in 2020, coupled with the various provisions in the CARES Act, companies should reevaluate their ability to utilize deferred tax assets. Additional or new valuation allowances may be necessary. Significant modeling exercises may be required to properly account for the various provisions of the CARES Act and their impact on the income tax provision.

The tax provisions of the CARES Act are designed to provide taxpayers with much-needed liquidity. It is critical for business taxpayers to perform quantitative modelling and consider the overall impact of the various provisions before making a decision in order to fully optimize the benefits. RKL is closely monitoring the ongoing developments to provide clients with timely assistance during the economic hardship related to COVID-19 – visit our Coronavirus Resource Center for the latest guidance and insights. Contact your RKL advisor with any questions and analysis and filing needs.