Personal federal withholding check-ups have long been recommended for employees, but the disruption associated with the coronavirus pandemic makes this best practice even more vital in 2020. With so many individuals and families experiencing personal and financial changes due to COVID-19, it is critical to review your information on Form W-4 to avoid any surprises at tax time.

Changes Impacting Tax Liability

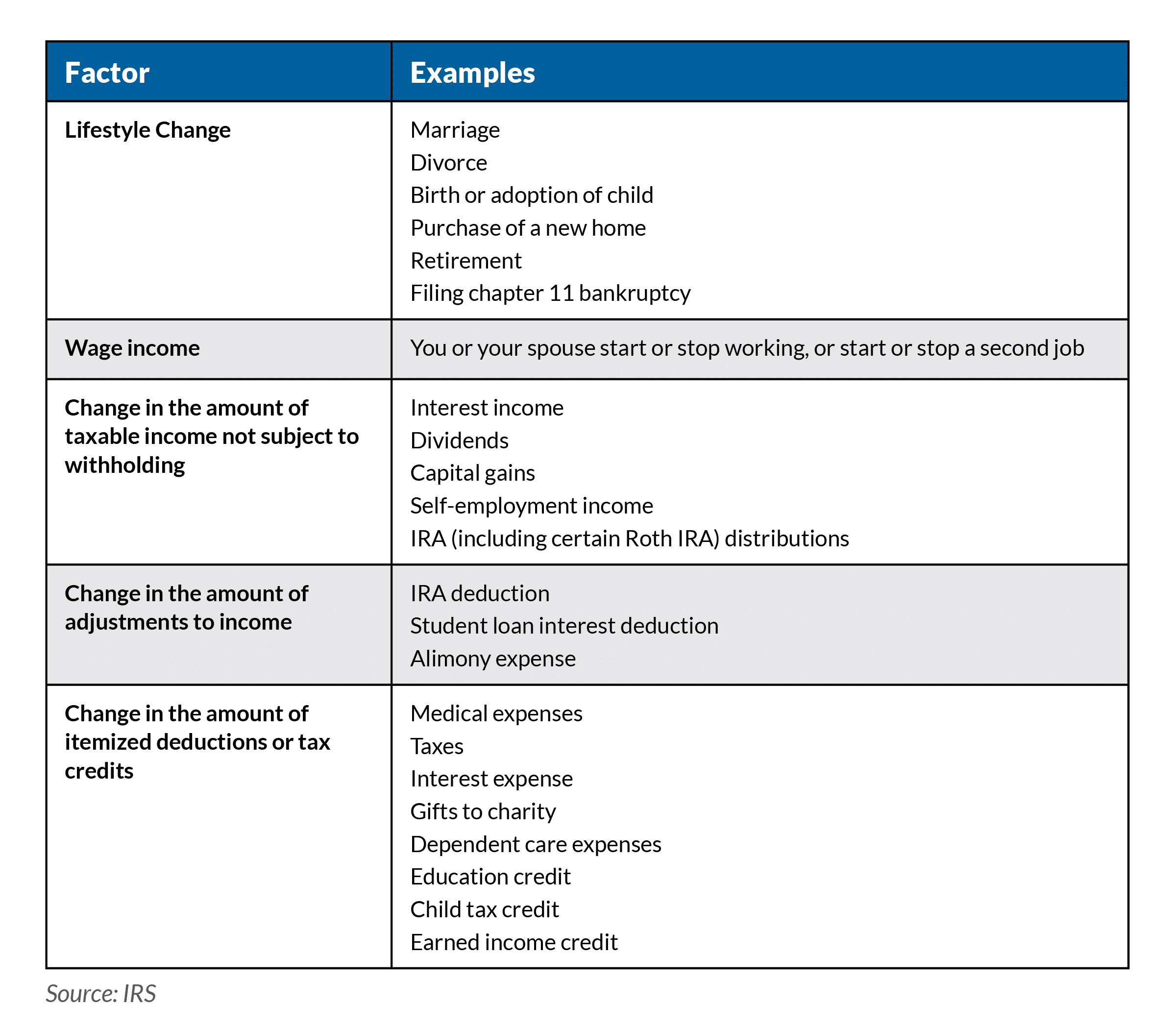

There are a number of personal events and financial changes that can impact household taxation under the Internal Revenue Code and trigger subsequent tax requirements. Taxpayers experiencing any of the below circumstances should review Form W-4 and adjust withholding accordingly.

COVID-19 is forcing individuals and families to confront a range of challenges, including eliminated or reduced work hours, unemployment benefits and changes to child care arrangements. While Pennsylvania unemployment compensation (UC) is not taxable income at the state and local level, it is considered taxable wages for federal income tax purposes. When applying for UC benefits, individuals are able to choose a 10 percent federal income tax deduction, but this percentage is based on UC benefits only and may not reflect a true tax liability based on all taxable wages in the year.

Furthermore, some recipients may currently be receiving more wages in UC benefits than they did while working, due to supplemental emergency federal assistance that expires at the end of July without congressional action. This change in income level may cause under-withholding, resulting in tax due on individual 2020 tax returns. Recipients should include UC benefits in their withholding reviews to ensure appropriate taxation of all 2020 income.

Form W-4 Reminders for Employers and Employees:

- Employees can change their W-4 at any time. The employer is required to update the withholdings by the start of the first payroll period ending the 30th day from the date received.

- Employers are required to obtain a signed (or electronically completed) W-4 to change an employee’s federal withholdings. Employers cannot accept phone calls or emails.

- Employers should encourage employees to conduct annual and mid-year W-4 check-ups as part of regular internal communication messaging.

- A new W-4 was finalized in early 2020. Employers and employees must ensure they are using and distributing the most recent version.

- Employers cannot assist employees in completing their W-4. Free resources and tools should be provided (like the IRS Tax Withholding Estimator and Paycheckcity.com) to assist employees in making educated decisions around withholding in light of their personal circumstances.

RKL’s team of payroll advisors is available to answer questions about Form W-4 and withholding matters. Contact your RKL advisor or use the form below to get started.