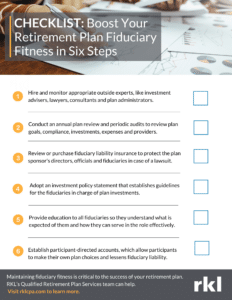

As a retirement plan fiduciary, many critical tasks fall to an employer. It’s essential that employers perform these tasks correctly and with the proper due diligence, as there is liability associated with serving in a fiduciary role.

A retirement plan fiduciary can be subject to criminal and civil penalties by participants and beneficiaries if they’re found to have breached their duty. The fiduciary is personally liable for losses that occur due to a breach and must make participants or beneficiaries whole. The U.S. Department of Labor (DOL) can also apply a civil penalty up to 20 percent of the applicable recovery amount if a breach occurs. The DOL can waive or reduce penalties if it finds the fiduciary acted in good faith, so it is important to maintain compliance. Here are six ways to improve your retirement plan fiduciary fitness:

1. Hire and monitor appropriate outside experts:

Fiduciaries are permitted to hire professionals help them with tasks related to retirement plan management and transfer some fiduciary liability. Investment advisers can work with plan members to offer investment option recommendations or transfer responsibility to an investment fiduciary. You may also consider adding lawyers, consultants and plan administrators, like RKL, to your team. These experts can help with a number of tasks to lower Plan Sponsor responsibilities and liability along with providing additional education for the Plan Sponsor.

2. Conduct annual plan review and periodic audits:

Conducting an annual plan review each year to review plan goals, compliance, investments, expenses, and providers should be done with the plan committee and their advisor. Also, create a schedule to conduct routine self-audits. Use this time to review your plan and ensure everything is being administered in accordance with the plan document, the Internal Revenue Code and Employee Retirement Income Security Act (ERISA).

3. Review or purchase fiduciary liability insurance:

Fiduciary liability insurance provides broad coverage to the plan sponsor’s directors, officials and fiduciaries and protects their personal assets from lawsuits alleging breach of fiduciary responsibility. Be sure the policy specifically covers ERISA claims. If you already have fiduciary liability insurance, review your policy to ensure it offers the necessary coverage for your organization. Fiduciary liability insurance is different than the required Fidelity bond which covers participant from losses.

4. Adopt an investment policy statement:

Put together a written statement that establishes guidelines for the fiduciaries in charge of plan investments. Your plan advisor typically assists with this or you can work with an experienced professional. This statement should outline the purpose of the plan, the investment objectives, who is responsible for the investment due diligence and the process in place for selection, monitoring and replacement of plan investments. All outside consultants that assist with plan management must also adhere to this policy.

5. Provide education to all fiduciaries:

As a fiduciary, there are certain things you need to do and certain things you should not do. It’s necessary to take the time to educate yourself and anyone involved with working with the plan on what is expected of you and how to serve in this role effectively. You are expected to act on the plan’s behalf in the best interest of employees to perform the processes and procedures that are part of plan management, choose a plan provider and investment manager, and make decisions related to the plan. Since plans can have more than one fiduciary, be sure to provide this education to everyone serving in a fiduciary capacity.

6. Establish participant-directed accounts:

The majority of defined contribution plans are participant directed, but not all. By allowing participant directed accounts, the plan participant makes their own choices regarding their investments. Under these plans, fiduciaries are no longer liable for participant losses as long as they are compliant with the proper ERISA requirements and associated regulations. Be sure to properly inform participants that they are responsible for their own investments.

Maintaining your fiduciary fitness is critical to the success of your retirement plan. RKL’s Qualified Retirement Plan Services team is experienced at serving these needs and can help support your organization. For more advice on how to improve in your role as a fiduciary, contact your RKL advisor or use the form below to get started.