Everyone can agree on the benefits of an integrated and optimized financial management system – improved efficiency, reduced costs, better data and insights – but how should an organization get started? In this series, we outline three critical components needed to build a technology foundation that pays dividends for your organization.

A financial management system is only as dynamic as its chart of accounts, which affects an organization’s entire finance and accounting function. In part one of this series, we discussed the importance of a well-designed, modern chart of accounts. One way to achieve this goal is to add dimensional reporting to your system. Below, we’ll look at how dimensions elevate the traditional hard-coded chart of accounts and deliver real-time, dynamic financial reporting.

The Downside of Hard-Coded Chart of Accounts

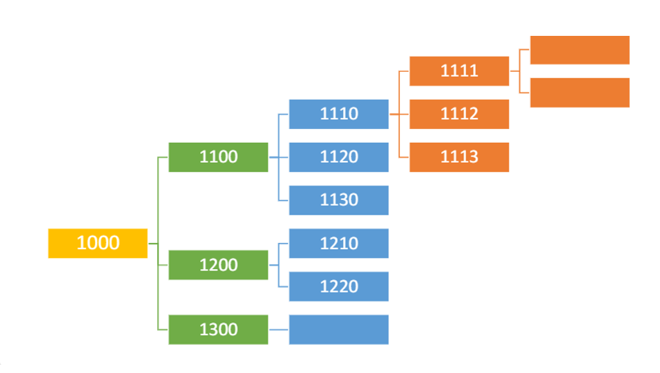

Many accounting software solutions use a hard-coded structure, which causes the chart of accounts to be unnecessarily rigid and complex. Under this model, the chart of accounts structure tends to produce thousands, if not tens of thousands, unique account numbers. For example, in a traditional chart of accounts, if you have five funds, four grants, three programs and one restriction, you would need to set up 60 general ledger number for every account.

It is easy to see how a hard-coded chart of accounts can quickly become unwieldly, confusing and hard to manage. Manual set-up takes a lot of time and has a higher risk of errors. On the flipside, when a leader requests a report, the finance team spends more time and effort to search, manipulate and format the information at the expense of deeper data analysis.

Benefits of a Dimensional Chart of Accounts

Modern financial management solutions, such as Sage Intacct, offer a solution to this complex, error-prone and time-consuming problem. Instead of account number segments, these systems use of dimensional values to capture the business context of every transaction and easily track performance by customer, project, department or any other business driver.

A dimensional chart of accounts lets management tag transactions with certain attributes, which can align with the organization’s specific needs or goals. Other benefits of a dimensional chart of accounts include:

- Improved accuracy and streamlined operations from reduced chart of accounts volume

- More timely and efficient financial close process

- Enhanced quality of financial reporting

- Reduced need or reliance on Excel spreadsheets

- Ability to slice, dice and drill down into data and add context to any transaction with just a few clicks

Precise financial insights drive successful company management. Traditional accounting solutions with an inflexible chart of accounts cannot deliver financial reporting that provides multi-dimensional analysis of key results. Contact your RKL advisor or use the form if you are ready to apply the power of dimensions to your organization.

In our third and final installment of this series, we’ll explain how the final phase of a strong accounting infrastructure – dashboards – can help drive change, accountability and improvement.