Rarely do buyers and sellers in an M&A transaction see eye-to-eye on everything. This truth is most apparent in the price negotiation and what is commonly referred to as a valuation gap. Most commonly, that valuation gap exists because a seller thinks its business is worth more than a buyer is willing to pay. This is one of several bumps in the road that can appear as a buyer and seller negotiate and agree on transaction terms. Thankfully, there are a number of ways to keep a deal alive, including 338(h)(10) elections and earnouts.

An earnout is contingent consideration paid to the seller based on future performance of the target company in an M&A transaction. The key words here are contingent and future. Let’s use an example to illustrate this concept.

Earnout Example

If the seller thinks the business is worth $10 million and the acquirer believes it is worth $9 million, they can agree on an initial price of $9 million and the remaining $1 million can be structured in an earnout.

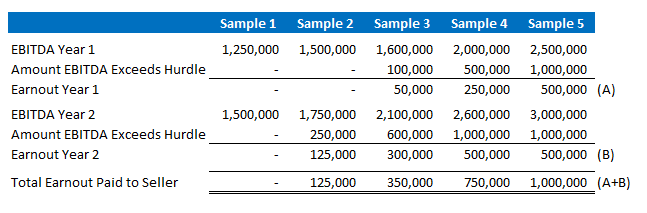

For this simple example, let’s suppose the buyer and seller agree to a tiered earnout over two years where the seller is paid 50 percent of annual EBITDA between $1.5 million (floor) and $2.5 million (ceiling). The below table demonstrates sample outcomes at different EBITDA levels.

This example shows one method for using a tiered earnout metric where the buyer/seller allow for partial satisfaction of the earnout performance obligation, as opposed to an all or nothing earnout. Likewise, the earnout in our example includes a ceiling or cap to limit the earnout payment to $1 million, even if the actual EBITDA results are well in excess of the established benchmark. It is not unusual for earnouts to include percentage or pro-rata provisions to enable partial satisfaction of an earnout. Likewise, an earnout may be structured with or without a cap, although the latter is not as common.

It should be noted that earnouts can range in size, time period and structure. Earnouts often range from five to 50 percent of the total consideration paid in a transaction. Various performance metrics can be utilized in an earnout, such as: EBITDA margins, revenue, gross profit, employee retention and contract renewals, among others.

When does an earnout make sense?

As alluded to previously, earnouts are commonly used when there is valuation gap, whether perceived or real. A seller may have a laundry list of reasons for why the business is going to take off, but past performance is still the primary reliable source for predicting future results. As a result, a buyer may only want to pay a certain price.

An earnout can provide a win-win solution to getting a deal done. In many cases, the seller is paid the majority of cash at closing with a portion that is contingent on certain earnout provisions. If the business performs as strongly as the seller believes it will in the future, the buyer is likely going to be pleased with this result and recognize that the additional consideration to be paid is fair. Alternatively, if a buyer takes over the business and it fails to achieve the agreed-upon performance metrics in the earnout, then the buyer is not stuck overpaying.

An earnout can provide a win-win solution to getting a deal done. In many cases, the seller is paid the majority of cash at closing with a portion that is contingent on certain earnout provisions. If the business performs as strongly as the seller believes it will in the future, the buyer is likely going to be pleased with this result and recognize that the additional consideration to be paid is fair. Alternatively, if a buyer takes over the business and it fails to achieve the agreed-upon performance metrics in the earnout, then the buyer is not stuck overpaying.

Potential earnout pitfalls (and best practices to avoid them)

Buyers and sellers have inherently opposite interests when it comes to price. All else equal, buyers wish to pay as little as possible while sellers wish to maximize their payday. Earnouts are intended to help align these competing interests.

To avoid pitfalls, however, it is important to address several issues upfront, including:

What earnout performance metric will be used? Will it be a financial metric or non-financial metric? Thinking of an income statement from top-to-bottom, an earnout could be based on revenue, gross profit, EBITDA, operating income (EBIT) or net income. Generally, the further down the income statement, the more potential for issues. This dynamic can arise when buyers are focused on long-term profitability, which may result in decisions that negatively affect the likelihood of achieving an earnout hurdle in the short-term. Sellers, on the other hand, may prefer to base an earnout on revenue or gross profit, where there is less ability for the buyer to control the earnout achievability with strategic/discretionary overhead expenditures.

- Best practice: Openly discuss the pros and cons of earnout metrics early so that the buyer isn’t left making short-term decisions at the expense of future profitability and the seller isn’t left with zero control. Additionally, consider whether it is appropriate to consider management fees, allocations or similar charges as part of operating expenses, which would reduce earnings-based metrics.

How will the accounting principles be defined to measure the earnout metric/hurdle? For example, if the earnout is based on a certain level of EBITDA, is EBITDA clearly defined or will there be certain allowable adjustments? References to GAAP alone may not be sufficient.

- Best practice: Include an example formula in the purchase agreement to be followed. If GAAP will be used to govern the accounting principles used in measuring the earnout, be sure to stipulate that GAAP will be applied consistent with the seller’s historic practices and, if needed, there are separately agreed-upon accounting principles to address exceptions to certain GAAP provisions. Lastly, if the acquired business is going to be integrated into the buyer’s existing business, ensure that segregated accounting records are maintained to ensure the earnout performance can be accurately measured and validated.

How long will the earnout period be? Buyers sometimes want a longer period to prove out the business while a seller will typically seek a shorter period with a higher retention to receive faster payment and maximum proceeds. Given the timing of an earnout, are there competing interests related to operational decisions when it concerns the long-term interests of the business?

- Best practice: When negotiating an earnout structure, understand the need to establish a fair and equitable time period while not hindering day-to-day business decisions based on the impact to earnout performance metrics. Consider acceleration rights to provide for events such as bankruptcy, sale of business or change in control.

Will the seller be involved in operations post-transaction and, therefore, during the earnout period? Depending on the type of earnout metric being used, a seller may feel as though they are at the mercy and competency of the buyer as it pertains to meeting the earnout hurdle.

- Best practice: Ensure the future roles of buyer and seller are clearly defined so there aren’t questions when certain operational decisions need to be made. At minimum, the seller may want restrictive covenants that set limitations on how the business may be operated to prevent the buyer from making significant changes that result in reducing the earnout. One such mitigation technique is to include a clause enabling the seller to have approval rights over major decisions. That said, buyers typically do not want sellers to retain much, if any, influence over operations, so this is often a tricky proposition.

Ultimately, the key is to address these details early in the process and in sufficient detail to eliminate headaches and disputes down the road. Despite best intentions, there are still occasions where disputes will arise over some facet of an earnout. To prepare for this, appropriate provisions should be built into the purchase agreement as to how such disputes will be handled. Typically, the earnout calculation is prepared by the buyer, reviewed by the seller and then approved by both parties. If there are disagreements, an independent CPA may be engaged as the third-party arbitrator.

Deciding how to structure your next transaction can be a complicated process. When evaluating the merits and limitations of an earnout, it is important to have capable advisors that can translate the complexities and provide meaningful guidance. RKL’s Transaction Advisory Services team can help you gain a competitive advantage in planning and executing your next transaction. Contact your RKL advisor or reach out via the form below to get started.