Over the past 12 months, the federal government has enacted four major relief bills to mitigate the financial and economic disruption of COVID-19. The most recent act, the American Rescue Plan, extends existing measures like paid leave, unemployment benefits and payroll tax credits and introduces new elements like COBRA premium assistance and increases in the Child Tax Credit.

The American Rescue Plan also expands existing or creates new grant programs for small businesses in certain industries, such as entertainment venues and restaurants. PPP loan and Employee Retention Tax Credit recipients may apply for these grants, which will be reduced by the amount received through either program.

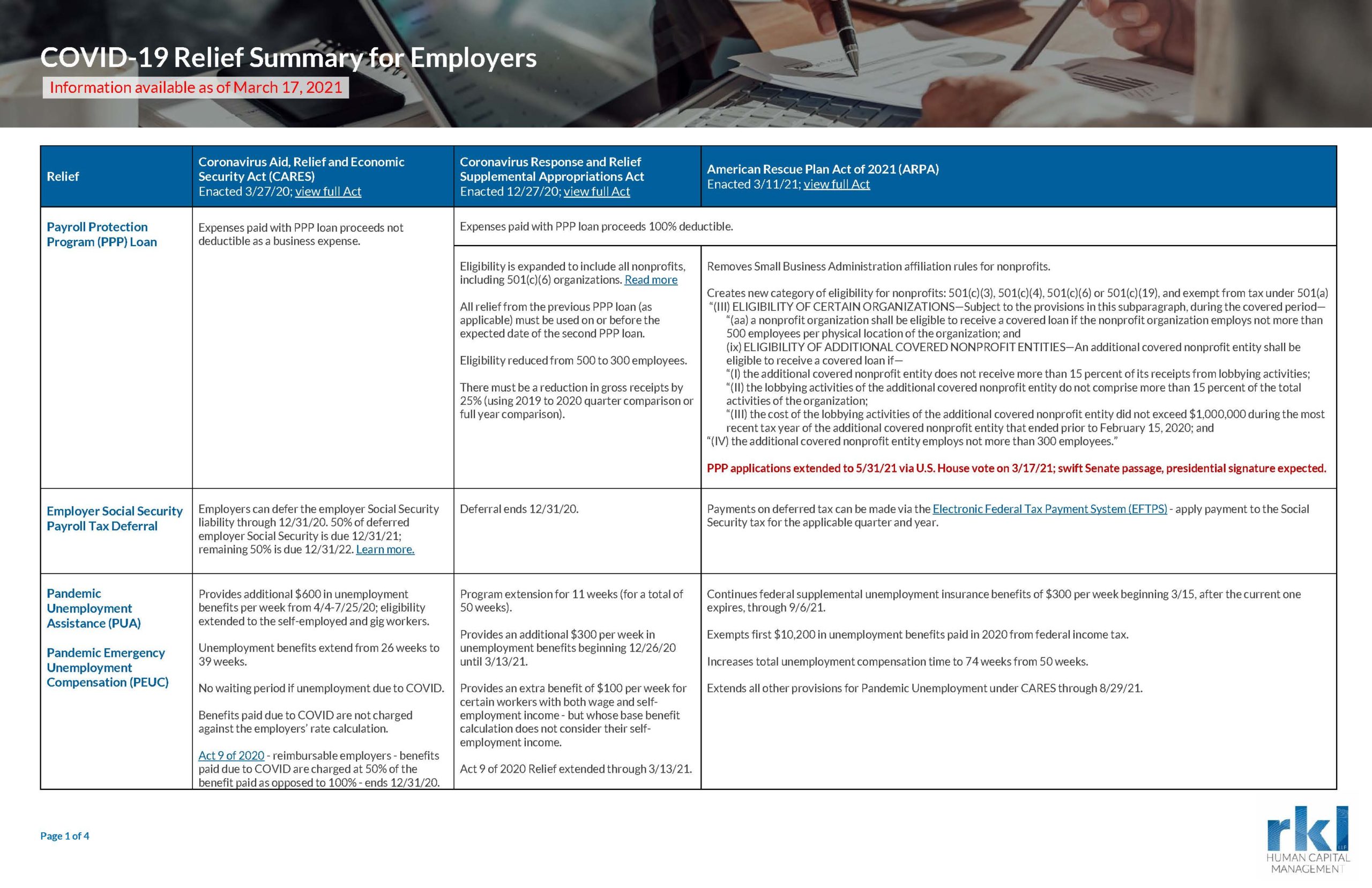

To help employers track the evolution of certain provisions and understand how they apply to their workforce, RKL’s Human Capital Management team created a comprehensive guide that summarizes the Families First Coronavirus Response Act, the Coronavirus Aid, Relief and Economic Security (CARES) Act, the Coronavirus Response and Relief Supplemental Appropriations Act and the American Rescue Plan Act.

Download the summary below. Contact your RKL advisor with any questions or reach out using the form beneath this post.

(Click here to download/enlarge)