We’ve all heard the cautionary phrase, “Past performance is not indicative of future results.” While this is an important disclaimer for investors, business leaders can defy this conventional wisdom and extract greater insights into financial potential from their routine projections. All it takes is the incorporation of a little more data, as RKL analysts explain below.

Common Financial Projection Techniques

Financial analysts generally have four main methods at their disposal to forecast business growth: straight-line, moving average, simple linear regression and multiple linear regression.

Many businesses use the straight-line technique, in which revenue predictions for the following year are based on a specific growth rate related to historical performance. Others rely on moving averages, which smooths any outliers during the given time period to predict an average performance moving forward.

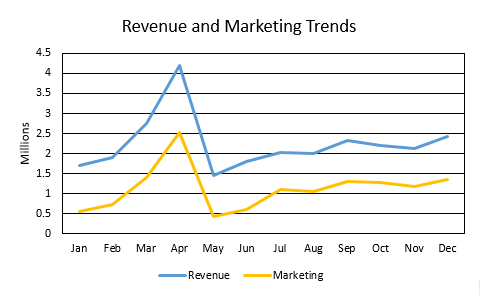

Simple linear regression is gaining in popularity because it allows business leaders to examine the relationship between a dependent variable, like revenue or expenses, and an independent variable, like marketing costs or capital expenditures, and project the impact that changes to the latter would have on the former.

Multiple linear regression follows the same approach, but pulls in multiple variables for a more holistic look at the relationship between the various revenue streams and cost centers in a business.

How Data Analytics Enhance Financial Projections

Adopting a more sophisticated financial projection technique supported by data analysis positions leaders to make better, timelier decisions and take a more proactive approach to business planning. Not only can your organization reap the benefits of a more predictive and reliable projection, but scrutinizing historical performance data across a variety of business lines can reveal pain points to resolve. Specifically, data analytics can bolster an organization’s accuracy in predicting key areas like cash flow, late payment probability and sales goals.

Best Practices for Incorporating Data Analytics into Financial Projections

The main challenge with analytics is the quality of the underlying data. Do you have good data to measure the variables involved in your organization’s projections? It is essential to determine this from the start; otherwise, putting unreliable data in will lead to unreliable outputs.

Once the quality of the data is assured, the next step is to translate it into actionable insights. If your organization does not have analytics expertise in-house, consider tapping into a trusted business advisor, like RKL, to design and implement a more sophisticated financial projection model and support your team to use it moving forward.

Contact us to learn how to harness the power of your organization’s data and use it to uncover new opportunities for efficiency and growth.