Tucked inside the Tax Cuts and Jobs Act is a new economic development initiative that offers preferential tax treatment for investments in distressed communities. Investors can support the revitalization of more than 8,700 low-income areas throughout the nation designated as federal Opportunity Zones by investing in Qualified Opportunity Funds (QOF) and deferring federal tax on their investment

Considering an Opportunity Zone investment? Here are some more details on the program and important things to keep in mind.

Federal Opportunity Zone tax incentives

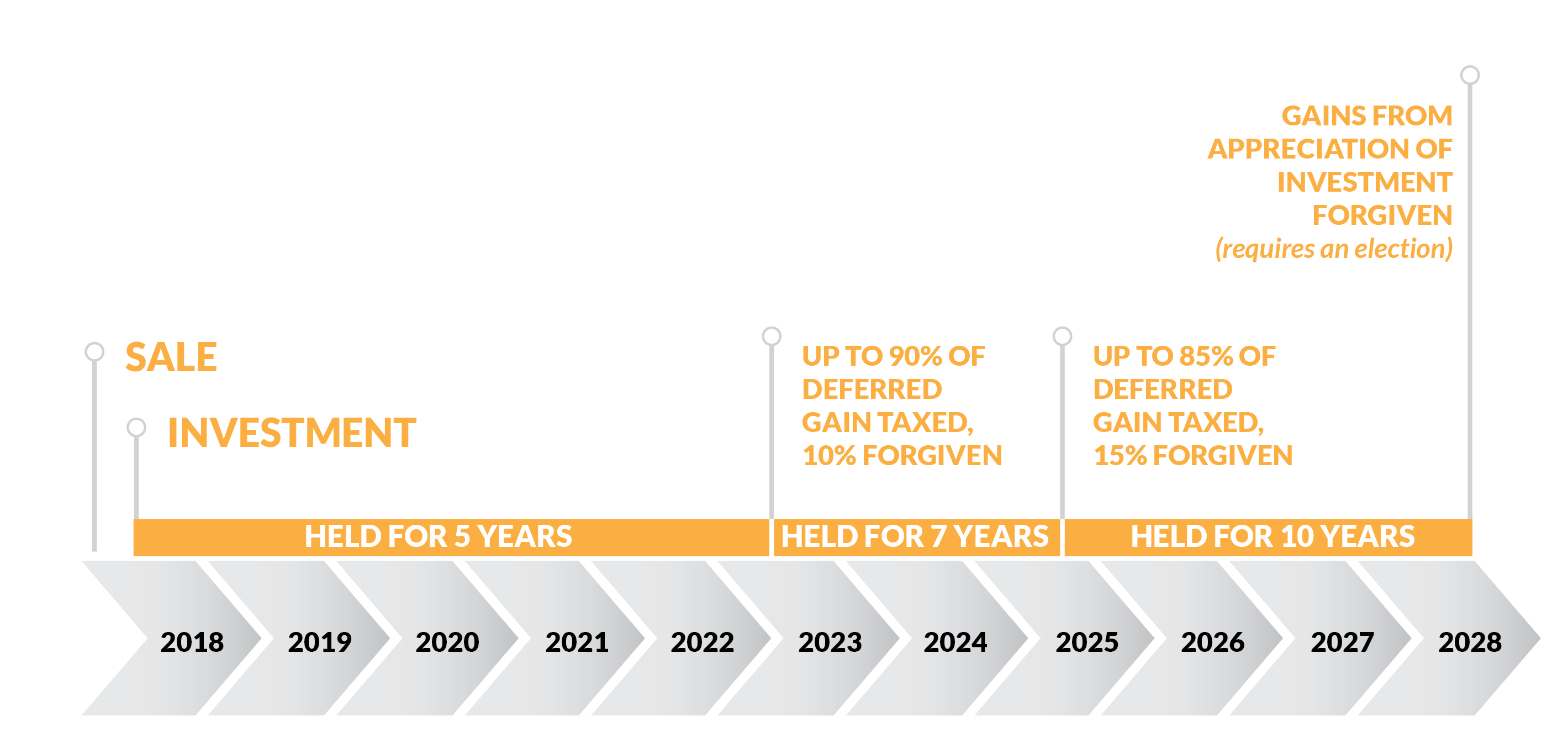

Investors can partially defer tax on the capital gains invested in a Qualified Opportunity Fund (QOF), which the IRS defines as “an investment vehicle set up as either a partnership or corporation for investing in eligible property or businesses that are located in a Qualified Opportunity Zone.” This deferral period ends either at the date of earlier sale or December 31, 2026, whichever comes first.

Investors can earn tax forgiveness of 10 percent of the originally invested capital gain when the QOF investment is held for at least five years. Holding for two more years (for a total of seven) provide an additional five percent tax forgiveness. After a 10-year holding period an investor can receive the added benefit of no tax on any realized appreciation on the QOF investment.

Federal Opportunity Zone investment criteria

Only capital gains (not ordinary) are eligible for the capital gains deferral through investment in a QOF. This includes both long-term and short-term capital gains, such as the sale of real estate, stock investments, artwork, collectibles, etc. Capital gains from the sale of business real estate property (in accordance with Section 1231) is also eligible.

The tax benefits of Federal Opportunity Zone investments only apply to the originally invested capital gain. Non-gain funds invested in a QOF are not eligible for tax benefits.

Timing is critical

For investors, there are a number of important deadlines and timing expectations in order to receive the full QOF tax benefits.

- 180 days: Investors must realize capital gain as result of sale of property (or exchange with unrelated person) and invest part or all of that gain into a QOF within 180 days. A person is considered related if he or she is a family member, spouse, ancestor or lineal descendant or owns more than 20 percent in stock or capital interest/profits. There are also special rules for controlled groups, grantors, fiduciaries and nonprofits.

- One capital gain investment per deferral period: The capital gain itself can only be invested once for the purposes of electing the capital gains deferral, but investors are permitted to break the proceeds into multiple investments made simultaneously. The entire initial investment must be disposed of before investing in a new QOF and electing a new deferral.

- Deferral period ends December 31, 2026: As of this date, investors must pay the tax on any capital gains so it will become important to either sell before the deferral period ends or have necessary cash flow in place to cover the tax bill (no prepayment allowed). After 2026, investors who continue to hold the investment and reach the ten-year mark will have no tax due on the original investment moving forward.

Eligible investors

Anyone recognizing a capital gain for federal income tax purposes is eligible for the Opportunity Zone tax benefits, including individuals, C Corporations (even real estate investment trusts and regulated investment companies), partnerships and other pass-through entities like common trust funds, qualified settlement funds or disputed ownership funds.

Pass-through entities can elect to make the capital gains deferral; if not, the deferral rolls down to the partner or shareholder level if it meets investor requirements outlined above. In such a case, the 180-day period would begin on the last day of the partnership’s taxable year.

As part of our ongoing efforts to provide real answers and insights related to tax reform and its many provisions and impacts, the RKL tax team is equipped to support clients considering a federal Opportunity Zone investment from investment to reporting to divestment. Contact your RKL advisor or one of our local offices to find out if this tax benefit is right for you and your investment portfolio.