The coronavirus crisis has left many businesses asking fundamental questions, such as “How do I meet my payroll?” and “How will I pay my vendors?” These questions were unthinkable just a few weeks ago, and are (hopefully) short-term obstacles. To help businesses survive these challenging times, a number of new emergency options have emerged and existing programs have been expanded at both the federal and state level. Read on for the latest details on these financing tools and what to keep in mind when evaluating them.

Short-term financing options

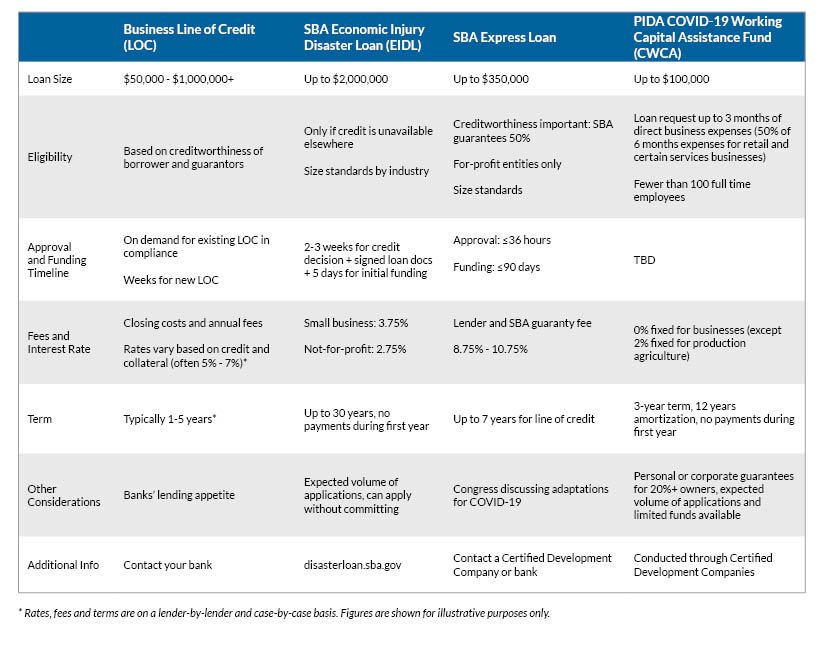

The first short-term financing option presented in the above chart, a line of credit (LOC), should be familiar to most business owners. While it hasn’t been a necessary financial lifeline over the past several years, some businesses have used them for working capital needs or to serve as a rainy day fund. Since it is officially pouring now, all business owners should consider securing a LOC if they do not already have one. It’s not the cheapest, but it is the most immediately available option. Banks continue to lend to businesses, subject to borrower creditworthiness.

The federal Small Business Administration (SBA) has two short-term financing options available to businesses. First, the Economic Injury Disaster Loan (EIDL) is a $50 billion program to infuse capital for small businesses affected by COVID-19. Small business owners and nonprofits in all U.S. states and territories are eligible to apply for these low-interest loans due to coronavirus disruption. The chart above outlines loan size and other financing details. Please note that small businesses with other sources of credit, such as a LOC with available capacity, are disqualified. Keep in mind this option is not limited to small Main Street shops. The SBA for the purposes of EIDL funding, defines small business as up to 1,500 employees (depending on industry) or revenue under $41.5 million (again, depending on industry).

- SBA EIDL advantages: Better rates than most LOCs, commitment-free application (given the volume of applications so far, business owners should apply soon if they suspect they may need it)

- SBA EIDL potential drawbacks: Timing (traditional EIDLs can take 3-4 weeks from application to initial funding release)

The other SBA option, Express Loans, are traditional offerings not specific to a disaster. On the plus side, approval takes place in just three days and it can be structured as a term loan or a LOC. On the down side, the funding itself can take up to three months so it may not have much of an impact in the short-term. More details and terms are outlined in the above chart.

PA financing and loan programs available now and in development

On Wednesday, March 18, the Commonwealth Financing Authority transferred $40 million to the Pennsylvania Industrial Development Authority (PIDA). Combined with existing funds in PIDA’s Small Business First Program, this new COVID-19 Working Capital Assistance Fund (CWCA) will make more than $60 million in loans available to businesses with fewer than 100 full-time employees. CWCA will provide loans of up to $100,000 with zero percent interest (in most cases), no application fees and no payments during the first year.

Applications for CWCA are now open. Businesses should contact their local certified development company to apply (statewide directory and central/eastern PA CDCs listed below). The following information is needed for the application process:

- Summary of adverse impacts to the business, including date closed if applicable.

- W-9 forms completed for the borrowing company.

- Most recent 2 years of filed federal tax returns or accountant financial statements. If you have not filed your 2019 tax return yet, please also include an internal or Quickbooks type balance sheet and profit/loss statement for 2019.

- A summary of existing business debt, current balances, and required monthly payments.

- Personal financial information of business owners including personal assets and liabilities.

As with any financing or loan option, small business owners must be sure to thoroughly review all the terms and fully understand the ramifications of different tools, especially any requirements related to a personal financial guarantee.

Additionally, more options are being considered at the local level and within different industry associations, so we will continue to monitor and update this post as needed. RKL is also closely monitoring the $2 trillion stimulus bill making its way through Congress. Among the many relief provisions (at the time of this writing) is $376 billion in relief for small businesses. This relief is expected to include a loan application outside the SBA program, with banks on the front lines providing funding. Few details exist at this time, so we will provide additional guidance around the stimulus bill when possible.

Your local certified development company (central and eastern PA offices listed below) is a great place for businesses to start learning more and tapping into these loan options. At RKL, we’re available to support the process by gathering information needed in the application or conducting specialized accounting work to enhance the loan proceeds. Contact our team using the form below.

- Certified Economic Development Organizations in PA (interactive map)

- Chester County Economic Development Council – 610.321.8241

- Greater Berks Development Fund – 610.898.7794

- EDC Finance Corporation (Lancaster) – 717.397.4046

- York County Economic Development Corporation – 717.848.4000

- Lebanon Valley Economic Development Corporation – 717.274.3180

- Capital Region Economic Development Corporation – 717.213.5042

- Montgomery County Development Corporation – 610.272.5000

- Lehigh Valley Economic Investment Corporation – 610.266.6775

- Schuylkill Economic Development Corporation – 570.622.1943

- Northeastern Pennsylvania Alliance – 570.655.5581