Now more than ever, employers are looking for creative ways to acknowledge the hard work and resilience employees have demonstrated in these unprecedented times. Bonuses, extra pay and non-cash rewards can be excellent motivators to improve employee engagement and productivity. As with all things labor-related, however, employers must be mindful of potential regulatory concerns and execute properly to remain compliant. Read on for a primer on the different types of bonuses and pay and examples and guidance on how to administer properly.

Discretionary vs. non-discretionary

The U.S. Department of Labor (DOL) specifically addresses two type of bonuses: discretionary and non-discretionary.

- Discretionary bonuses can be added “as is” to employees’ gross pay. A discretionary bonus is not promised, expected or based on the employees’ production or work. It can be provided as a one-off, recognition reward.

- Non-discretionary bonuses require a recalculation of employees’ premium pay (more on that below). A non-discretionary bonus is promised and expected as communicated by an employer or included in a formal or informal agreement. Examples include attendance, on-call or production bonuses, commissions, retro-pay or the fair market value of an item given as an incentive.

In practical terms, if a manager tells an employee they will give them a $50 gift card if they are willing to take an extra shift, this is a non-discretionary bonus. It is also fully taxable to the employee, even if it is a $1 gift card. Cash is always taxable and a gift card is cash. If you offer employees an extra $100 a week for working during the COVID-19 pandemic, this too is a non-discretionary bonus.

How do bonuses affect hourly employee pay?

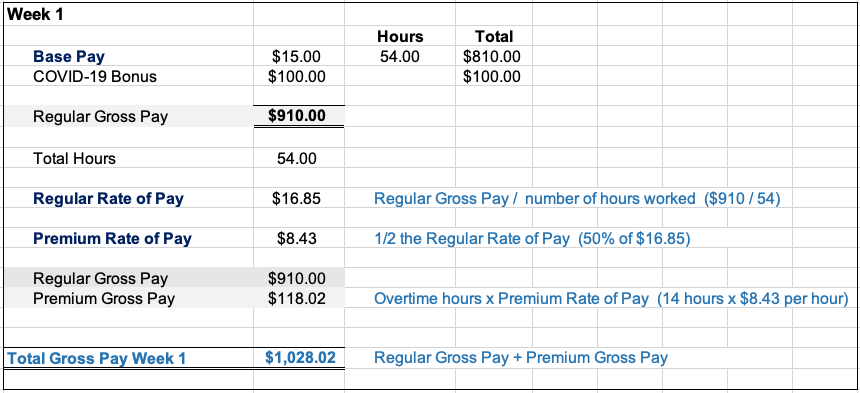

There are three rates of pay for every hourly employee: base rate, regular rate and premium rate. When an employee receives non-discretionary bonuses or supplemental payments, the regular rate of pay (and premium rate of pay) can change.

- Base rate: the hourly rate of pay offered to an employee when hired (and future increases)

- Regular rate: the blended rate of pay for all employee compensation (base pay, bonuses, on-call pay, shift differentials, etc.)

- Premium rate: ½ the regular rate

What does all of this have to do with an employee’s overtime or premium pay? Here is an example.

Joe is an hourly employee with base pay of $15 per hour. Joe has agreed to work his regular hours during the COVID-19 pandemic. ABC, Inc. has agreed to pay Joe an extra $100 a week to recognize his service amidst the crisis. In Week 1, Joe works 54 hours. In Week 2, Joe works 47 hours. Joe’s pay calculation would be:

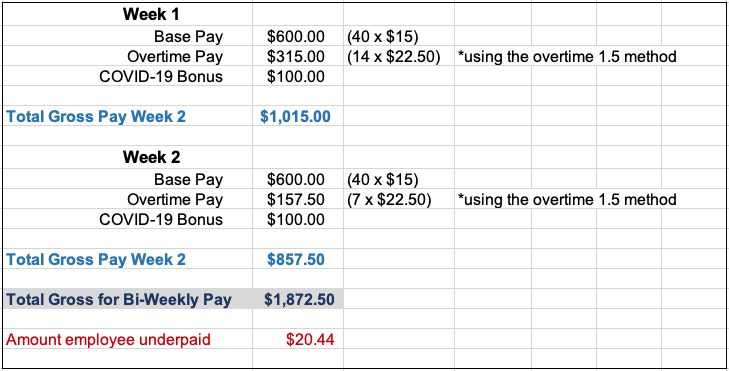

Joe’s gross bi-weekly pay would be $1,892.94.

If calculated incorrectly, Joe would be underpaid $20.44, as calculated below:

Tips for Proper Administration of Bonuses

Cash incentives can be excellent tools to demonstrate to an employee that you are as committed to their well-being as they are to your company. If an employee works overtime, however, these can be an administrative burden when not properly promised or managed.

If you provide a bonus similar to our example above, this math will need to be completed manually and entered into the payroll system. Current payroll systems are not intuitive enough to understand how these payments should be processed and calculated.

There are ways to avoid these complex calculations. Instead of a flat bonus, offer a percentage of regular and overtime pay as a bonus. Use this wording for your COVID-19 incentive: “In a gesture of appreciation for your willingness to work during these unprecedented times, we are providing each of our employees with a bonus of two percent of your regular and overtime pay. This bonus will be provided on the subsequent pay.”

This approach avoids additional calculation, is an easy-to-understand formula for employees and may also incentivize them to work more hours to earn more pay from which to base the two percent.

Employees want to be valued and engaged. There are many creative ways to be an employer-of-choice while still being compliant with DOL regulations, including one created by Unique Pretzel, a Reading, PA-based bakery. Unique Pretzel’s VP/COO recently outlined the company’s easily managed and communicated solution in a LinkedIn article. This local example demonstrates that creative and thoughtful solutions are possible – it just may require a little outside-the-box thinking.

RKL’s Human Capital Management team is available to help employers devise, review or adjust their bonus procedures for compliance and maximum benefit. Contact your RKL advisor or use the form below for assistance and make sure to visit our Coronavirus Resource Center for more guidance and insights to help organizations navigate these uncertain times.