Will rising interest rates crush the decade-long bull stock market?

Inflation is back…and has not been at current levels (October U.S. Consumer Price Index year-over-year 6.2 percent) since the 1990s. Given that inflation has been trending below the Federal Reserve’s target of two percent since the financial crisis of 2007-2008, it is clear that the current high inflation environment is impacting both financial markets and consumers’ wallets. Currently, the U.S. Treasury 10-year tenor is yielding 1.65 percent having moved higher by 80bps (0.80 percent) year to date, and the S&P 500 Index has returned almost 24 percent year to date (Bloomberg 11/23/2021). To help us better understand the potential impacts on investing in a rising interest rate environment, we took a closer look at the financial data during the 1970s and 1980s.

Key Notes:

- We looked at high interest rate environments in the 1970s and 1980s, and the S&P 500 Index averaged positive rates of returns over both 10-year periods (yearly and monthly).

- Elevated interest rate levels in the U.S. Treasury 10-year yield did not always mean negative U.S. large-cap equity returns.

- Our results found that high monthly increases (rate-of-change) in interest rates (U.S. Treasury 10-year) on average had a negative impact on U.S. large-cap equity returns.

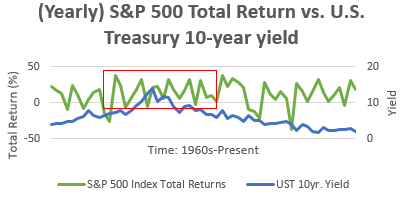

Here, we examine periods of high interest rate environments to evaluate their historical impact on U.S. large-cap equity market returns. The graph above illustrates how the U.S. Treasury 10-year yield has changed significantly over time while moving in and out of high and low interest rate environments. When we charted the historical return time series for the S&P 500 Index on the same graph, we see that equity returns can (and often do) post positive returns even in elevated interest rate environments.

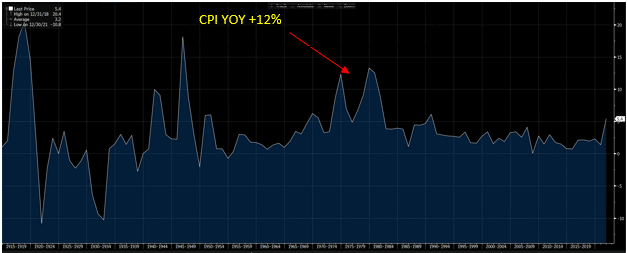

However, we can also see from the data that high interest rate environments (1973, 1974) can lead to large negative returns for U.S. large-cap equities. To dive further into this, we examined S&P 500 Index equity returns and U.S. Treasury 10-year interest rates during the 1970s and 1980s. Looking at historical time series data of U.S. consumer price index (CPI) year-over-year, CPI climbed north of 12 percent during both the 1970s and the 1980s. We thought the 1970s and 1980s would be an appropriate data sample to provide insight on how equities could perform in high interest rate environments. To accomplish this, we wanted to explore both the U.S. Treasury 10-year yield level and percentage increase in rates (from the prior period) to measure their potential impact on equity returns.

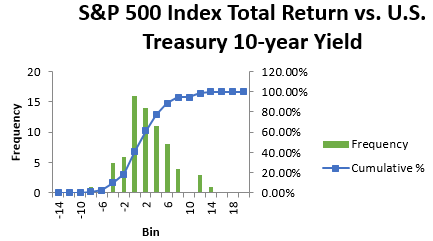

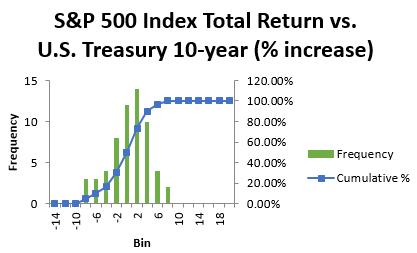

To increase the number of data points in our analysis, we looked at the monthly total returns for the S&P 500 Index during the 1970s and 1980s. In addition to getting month-end U.S. Treasury 10-year yield data, we also calculated the percentage increase in the U.S. Treasury 10-year interest rate from the prior month. Then we could compare equity returns to the absolute level and the rate of change in interest rates.

Elevated levels of interest rates do not necessarily mean that equity returns are going to be negative. We displayed how even during periods of high absolute interest rates equity returns can be positive. What is important for equity investors to monitor is how fast interest rates climb. If interest rates climb too fast because of a jump in unexpected inflation or an unexpected rate hike by the Federal Reserve, these events could lead to periods of negative equity returns.

In closing, take advantage of your individual time preference. To grow a given amount of money over time, an investor may increase the probability of achieving that result by expanding their investment time horizon and finding investments that have historically exhibited positive skewness (more positive than negative returns on average). U.S. large-cap stocks, as an asset class, have demonstrated the ability to weather the potential negative effects of a rising interest rate environment. Always remember, invest for the long run and stay disciplined. Contact your RKL Wealth Management advisor with questions about investment strategy or portfolio construction.