IRC 174 R&E Capitalization and Amortization Changes

One of the most significant impacts of the Tax Cuts and Jobs Act of 2017 on the business world was the Section 174 rules surrounding Research and Experimental (R&E) expenditures. These rules require taxpayers to capitalize and amortize R&E expenditures, which had previously been fully deductible. The changes, which took effect for tax years beginning January 1, 2022, required taxpayers to amortize the R&E costs incurred domestically over a five-year period (15 years for R&E costs incurred abroad). This resulted in taxpayers facing many potential issues, including a significant increase in taxable income and as a result, increased tax liabilities and an expedited use of net operating losses (NOLs).

While these new rules present challenges to taxpayers from a cash flow standpoint, there is potential for mitigation through tax planning, depending on the taxpayer’s specific situation. One of the most significant planning opportunities is available to companies with significant exports. Using the foreign-derived intangible income (FDII) deduction, these companies can mitigate the impact of the 174 rules.

Foreign-Derived Intangible Income Deduction

The FDII deduction was also created by the Tax Cuts and Jobs Act of 2017 and is effective for any tax years after December 31, 2017. The FDII deduction specifically creates preferential tax treatment for C corporations or partnerships with C corporations that export to foreign customers. This preferential treatment applies to sales, leases, royalties, and services to foreign customers.

The FDII deduction currently has a permanent tax benefit of 37.5% of the net income of qualified foreign revenue streams but will be reduced to 21.875% for tax years ending after December 31, 2025. This deduction results in permanent tax savings at a more favorable rate for tax years 2025 and prior.

Section 174 and FDII Planning Opportunities

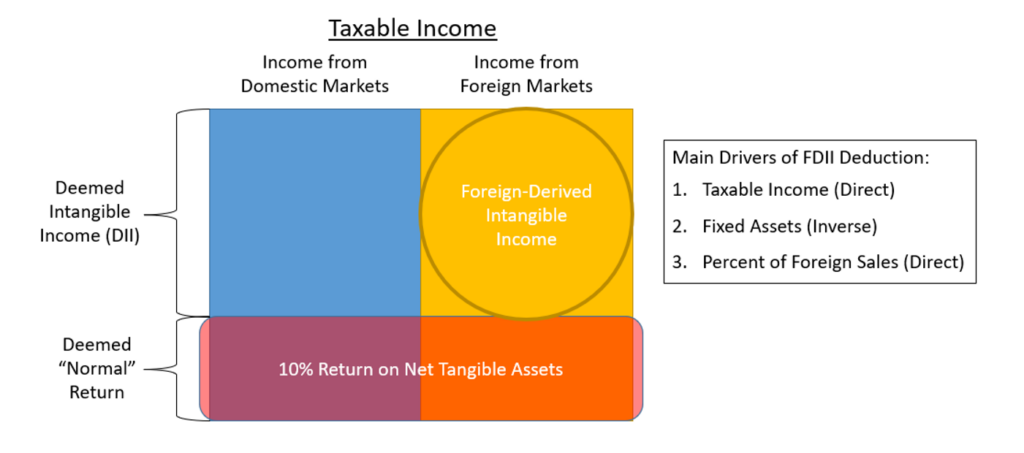

Beginning in the 2022 tax year, ample opportunities arose for corporations and corporate-owned partnerships that incur both significant R&E expenditures and significant export sales to foreign countries. As the FDII deduction directly increases when taxable income increases, the temporary R&E capitalization addback within these years will increase the permanent FDII deduction benefit.

This interplay allows entities with high export sales to fully take advantage of the permanent FDII deduction at the higher deduction rate, while the temporary 174 capitalization will decrease taxable income in future years when the FDII deduction is less valuable.

If you are a corporate taxpayer or corporate-owned partnership and believe you could take advantage of the interplay between Section 174 and the FDII deduction, contact your RKL Tax Advisor. The R&E and International Tax Teams here at RKL are available to discuss if these opportunities are worthwhile for your organization for the upcoming 2024 and 2025 tax years. By reviewing your 2022 and 2023 tax statements, RKL advisors can also determine additional benefits to enhance your strategic tax planning.