Taxpayers have experienced many changes this year, thanks to the COVID-19 pandemic. As 2020 draws to a close, there is one more area of change that may be lower profile, but still critically important: Form 1099 filling and reporting.

Recent Form 1099 changes stem from the Protecting Americans from Tax Hikes (PATH) Act of 2015, which accelerated filing deadlines from the last day of February to the last day of January for Forms 1099 that include reporting of nonemployee compensation amounts. Then, in July 2020, the IRS revived a form specifically for nonemployee compensation, Form 1099-NEC. Use this new form starting with the 2020 tax year for items of self-employment specific to nonemployee compensation.

Read on to find out when to use Form 1099-NEC and get other important reminders for 2020 tax year filing.

1099 Change: Revival of Form 1099-NEC

Starting with the 2020 tax year, certain business taxpayers receiving payments of $600 or more for nonemployee compensation from a payer will receive a Form 1099-NEC by February 1, 2021. This replaces the nonemployee compensation payment reporting on Form 1099-MISC.

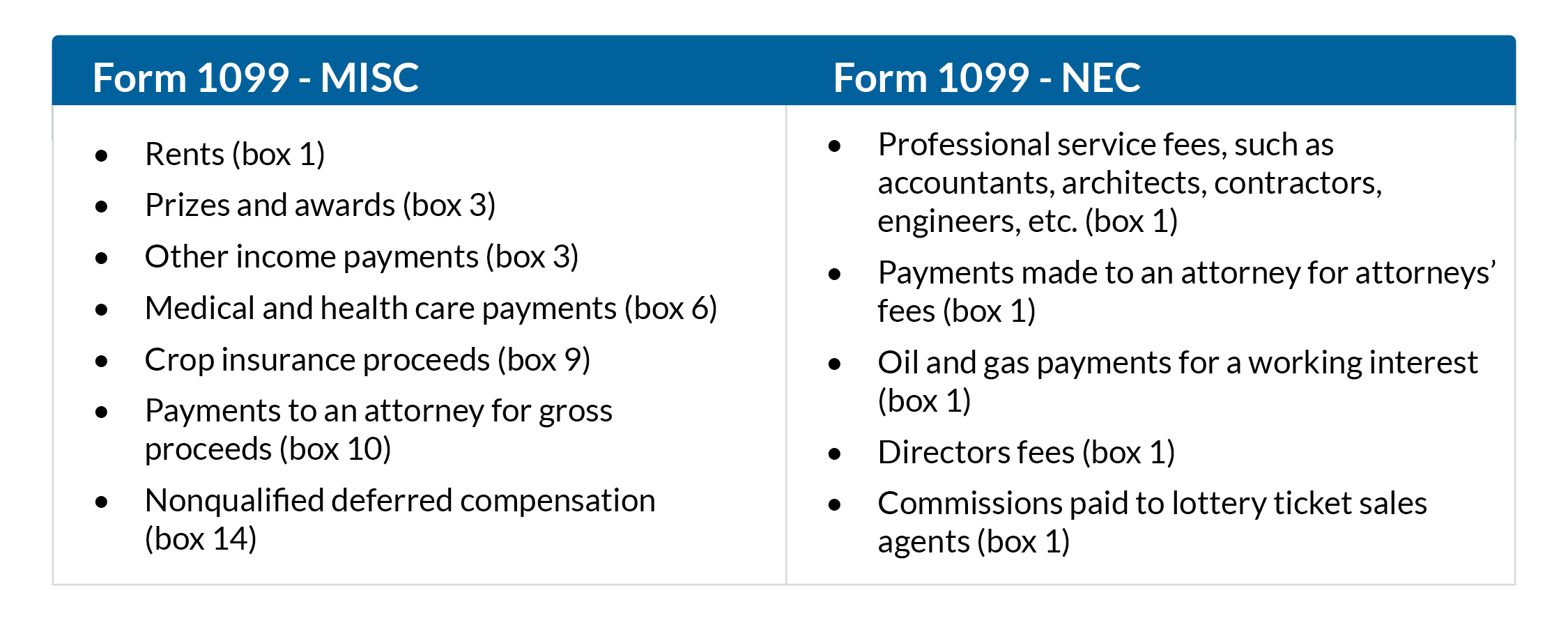

Form 1099-NEC, last used in 1982, adds another step of complexity when reporting certain nonemployee compensation payments received by individuals and businesses. There are certain nuances to determine whether to use a Form 1099-NEC or Form 1099-MISC to report transactions and payments.

Payments not subject to the $600 threshold for Form 1099-NEC must still file Form 1099-NEC in either of these circumstances:

- Federal withholding exists on any nonemployee compensation payments made to a recipient; prepare a Form 1099-NEC to report it and the corresponding amount of compensation.

- Royalties or similar payments exceed $10, prepare a Form 1099-MISC and record the amount in Box 1. Working interests in oil and gas activities are an exception, however. Since these payments are characterized for tax purposes as nonemployee compensation, the amount should be reported via Box 1 on Form 1099-NEC.

1099 Change: Accelerated Filing Dates

The PATH Act of 2015 accelerated the due date for filing Form 1099 that includes nonemployee compensation to January 31 (for both hard copy and electronic filings). For the 2020 tax year, Form 1099-NEC is due to the IRS on Monday, February 1, 2021.

Forms 1099-MISC are due to the IRS by March 1, 2021 if filing via paper, or March 31, 2021 if filing electronically.

Copies of Form 1099-NEC and Form 1099-MISC are due to recipient individuals or businesses by February 1, 2021.

1099 Change: Updated Reporting Requirements

Reporting methods will be different for 2020 as the result of the new Form 1099-NEC. Businesses should invest the time now to review policies and procedures related to record keeping and vendor management. Here are some best practices and tips to ensure accurate and efficient Form 1099 reporting:

- Review and update Forms W-9 for routine or reoccurring payments to vendors or others.

- Make sure a Form W-9 is on record for every recipient of a payment. It is a best practice to have this form on file before making any payments to vendors or others, instead of requesting it later in the year or during the tax filing process and risk not having complete and accurate information from which to prepare the Forms 1099. If the W-9 is not received by the time of any payment, 24% for backup withholding must be deducted.

- All Forms W-9 must contain the name, address, tax identification number and federal tax classification of the individual or business. Having accurate information up front will prevent wasted time securing later and amending the forms due to incorrect or incomplete information.

- Review vendor names and account classifications for accuracy in the general ledger to identify all payments for the year and note any differentiation between the nature and purpose of payments.

- Certain transactions, such as legal disbursements, may require more detail. Specifically identify and thoroughly describe payments to attorneys in a memo within the ledger or as a note in the vendor or legal file to ensure the correct Form is used and amounts reported.

Let RKL Help You Navigate Form 1099 Changes

Form 1099 filing mistakes and noncompliance can be costly and time-consuming. Avoid these headaches with support from RKL. Our tax professionals are here to answer any questions you may have about the new filing and reporting requirements. Contact your RKL advisor or reach out through the form below to get started.