All your 1099 forms have been filed with IRS and the vendor copies have been mailed – what a relief! While 1099 reporting is commonplace for business owners, did you know that a similar requirement exists for payments made to both foreign vendors and foreign-related parties? For most taxpayers, payments subject to this reporting, and the related tax withholding that must be paid to the U.S. government, will be for income that is passive in nature, such as interest, dividends, rents, royalties (including items deemed to be royalties, such as software subscriptions), premiums and annuities. Annual reporting on Forms 1042, 1042-S and 1042-T are due each year on March 15.

The rules for withholding tax on payments of U.S. income earned by foreign “persons” can be quite complex and missing a tax deposit during the year can be costly for your business. Developing a system to identify these payments with the support and assistance of a tax advisor is essential to staying in compliance. Here’s a quick checklist to get business owners started.

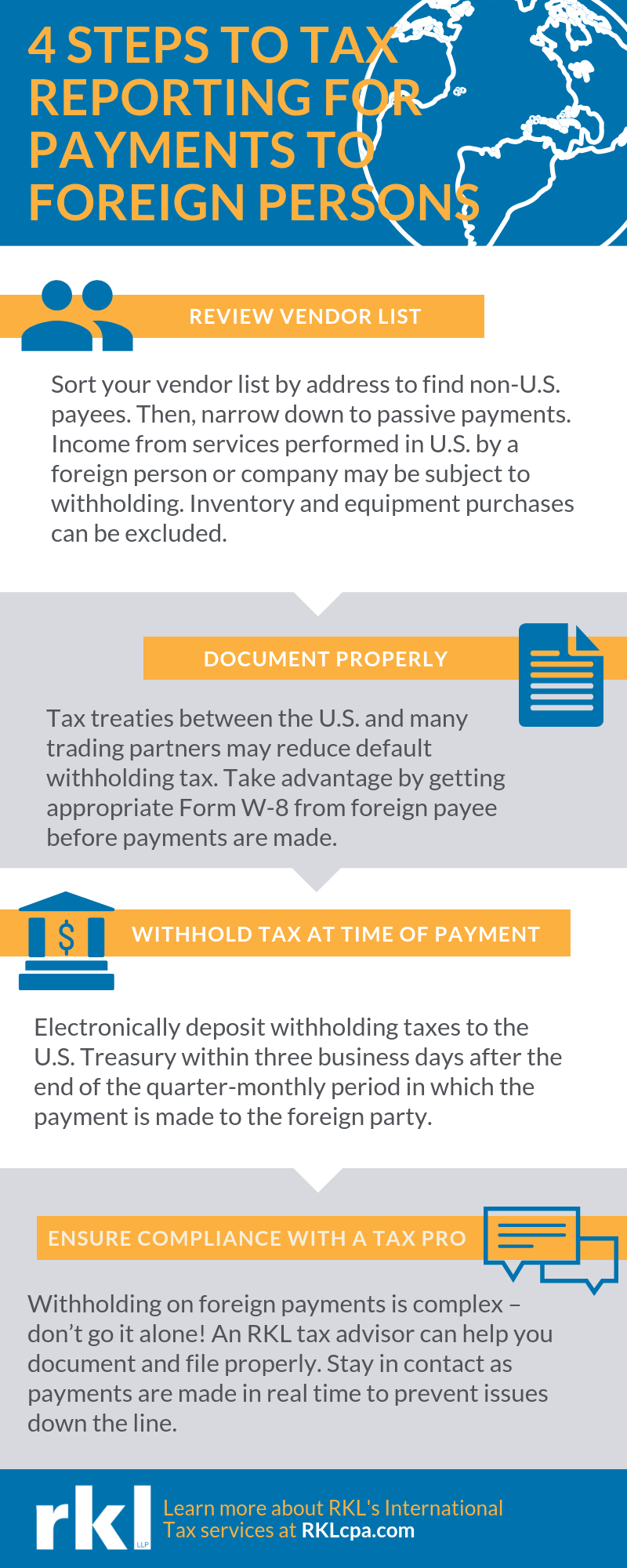

Step 1 – Review your vendor list

If you’re not already tracking foreign payees, start with thorough review of your vendor list. This will help you identify payments subject to withholding and establish a process for future monitoring.

Sorting the vendors by address (either by state or country) can quickly isolate most non-U.S. payees. From there, dig into the details and narrow the payments down to those that are passive (see examples above). Income from some services performed in the U.S. by a foreign person or company could also be subject to withholding, but purchases of inventory and equipment can be excluded.

Step 2 – Make sure necessary documentation is on file

The default withholding tax is levied at 30 percent, but tax treaties between the U.S. and many of its trading partners may reduce the tax rate significantly or even provide an exemption from tax entirely, depending on the type of income. In order to take advantage of these reduced rates, the payor (called the “withholding agent”) is required to obtain documentation from the payee establishing its residence and eligibility for the treaty benefit. Very similar to obtaining a Form W-9 from vendors based in the U.S., you should obtain a copy of the appropriate Form W-8 from the foreign payee before releasing any payment.

Step 3 – Withhold any tax due when payments are made

Being proactive is important in the area of U.S. withholding and falling behind can be expensive. Generally, withholding taxes must be deposited electronically with the U.S. Treasury within three business days after the end of the quarter-monthly period in which the payment is made to the foreign party (three business days after the 7th, 15th, 22nd and last day of the month). Interest charges apply to late deposits and late payment penalties can reach to as high as 25 percent of the unpaid tax in some cases. If annual Form 1042 filings are missed, late filing penalties up to another 25 percent of the tax can result.

Step 4 – Enlist help from a trusted advisor

As with most reporting for cross-border transactions, the various requirements for payments to foreign persons can be difficult to navigate and the risk of noncompliance is substantial. Tax professionals with experience in the international tax arena, like the team at RKL, can help business owners document the withholdable transactions and assist with preparation of the related filings. Don’t wait until the end of the year for advice – a few minutes of your advisor’s time before a payment is made will be well worth preventing potential issues down the line.

RKL has a team of tax professionals focused on international tax and helping companies throughout the region maintain compliance. Contact us today with any questions or assistance regarding tax reporting for payments to foreign persons.