Editor’s note: For a comprehensive guide to all four pandemic relief acts, download the COVID-19 Relief Summary for Employers, which tracks the evolution of certain provisions and introduces new benefits. For the most up-to-date information on the Employee Retention Tax Credit, please visit our ERTC Eligibility page.

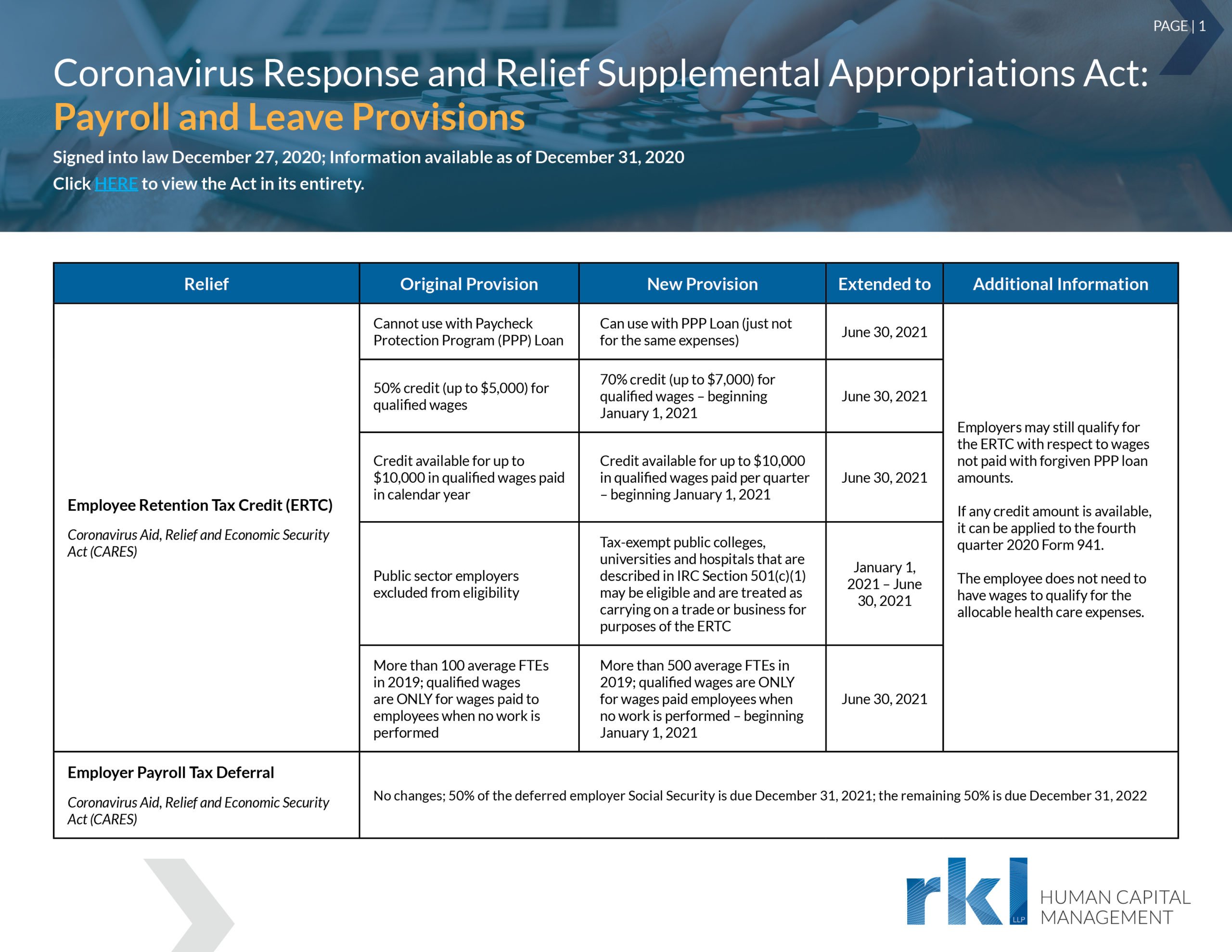

Signed into law December 27, 2020, the Coronavirus Response and Relief Supplemental Appropriations Act adjusts or extends for various timeframes many of the leave and payroll measures included in the Families First Coronavirus Response Act (FFCRA) and the Coronavirus Aid, Relief and Economic Security (CARES) Act.

Most notably, this latest coronavirus relief bill extends pandemic unemployment assistance through mid-March, makes the Employee Retention Tax Credit retroactively available to companies who received a first round PPP loan and continues emergency paid sick and family leave through the end of March.

RKL’s Human Capital Management team assembled a guide to help employers and payroll managers understand when and how these new provisions apply to their workplace. We also created an ERTC support package available for purchase to help employers maximize their benefit – learn more here.

Click here to read the Coronavirus Response and Relief Supplemental Appropriations Act in its entirety. For more detail on the FFCRA and CARES Act provisions, read our payroll cheat sheet and guide to COVID-19 payroll relief.

(Click here to download/enlarge)

Questions about these extended provisions and how they may apply to your company? Contact your RKL advisor or reach out using the form below. Visit RKL’s Business Recovery Resource Center for more guidance and information.