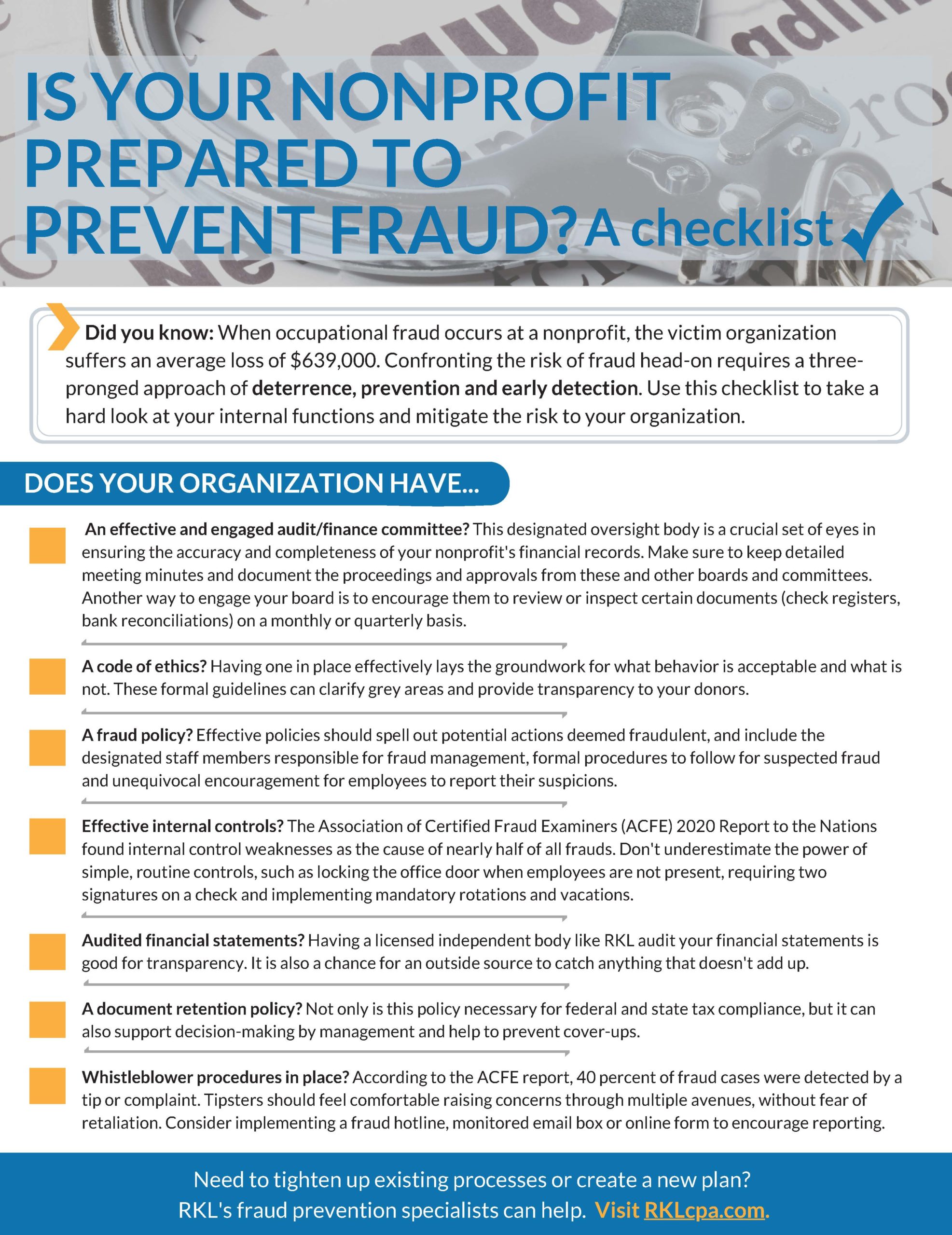

When occupational fraud occurs at a nonprofit, the victim organization suffers an average loss of $639,000. Confronting the risk of fraud head-on requires a three-pronged approach of deterrence, prevention and early detection. Use this checklist to take a hard look at your internal functions and mitigate the risk to your organization.

Does your organization have…

An effective and engaged audit/finance committee? This designated oversight body is a crucial set of eyes in ensuring the accuracy and completeness of your nonprofit’s financial records. Make sure to keep detailed meeting minutes and document the proceedings and approvals from these and other boards and committees. Another way to engage your board is to encourage them to review or inspect certain documents (check registers, bank reconciliations) on a monthly or quarterly basis.

A code of ethics? Having one in place effectively lays the groundwork for what behavior is acceptable and what is not. These formal guidelines can clarify grey areas and provide transparency to your donors.

A fraud policy? Effective policies should spell out potential actions deemed fraudulent, and include the designated staff members responsible for fraud management, formal procedures to follow for suspected fraud and unequivocal encouragement for employees to report their suspicions.

Effective internal controls? The Association of Certified Fraud Examiners (ACFE) 2020 Report to the Nations found internal control weaknesses as the cause of nearly half of all frauds. Don’t underestimate the power of simple, routine controls, such as locking the office door when employees are not present, requiring two signatures on a check and implementing mandatory rotations and vacations.

Audited financial statements? Having a licensed independent body like RKL audit your financial statements is good for transparency. It is also a chance for an outside source to catch anything that doesn’t add up.

A document retention policy? Not only is this policy necessary for federal and state tax compliance, but it can also support decision-making by management and help to prevent cover-ups.

Whistleblower procedures in place? According to the ACFE report, 40 percent of fraud cases were detected by a tip or complaint. Tipsters should feel comfortable raising concerns through multiple avenues, without fear of retaliation. Consider implementing a fraud hotline, monitored email box or online form to encourage reporting.

Need to tighten up existing processes or create a new plan? RKL’s fraud prevention specialists can help. Reach out to your advisor, contact one of our local offices or use the form below to get started.