Educational institutions, hospitals, social service organizations and other nonprofits are now eligible to apply for funding through the Main Street Lending Program (MSLP), thanks to a recent expansion of the program by the Federal Reserve. On July 17, 2020, the Fed announced the creation of two new loan options under MSLP to give greater access to credit to nonprofits experiencing financial hardship as a results of the pandemic.

New Lending Option for Eligible Nonprofits

One of the lower profile aspects of the CARES Act, MSLP makes $600 billion in loans available to small and medium-sized enterprises. Originally, only for-profit enterprises were eligible, but the Fed proposed a nonprofit expansion on June 15 and solicited public comments on the idea. The resulting feedback affirmed the Fed’s proposal and influenced the eligibility criteria and loan terms.

Nonprofit Eligibility and Loan Terms

Nonprofit organizations with 10 or more employees may apply for MSLP loans. Any nonprofit applicant must be classified under section 501(c)(3) or 501(c)(19) of the Internal Revenue Code.

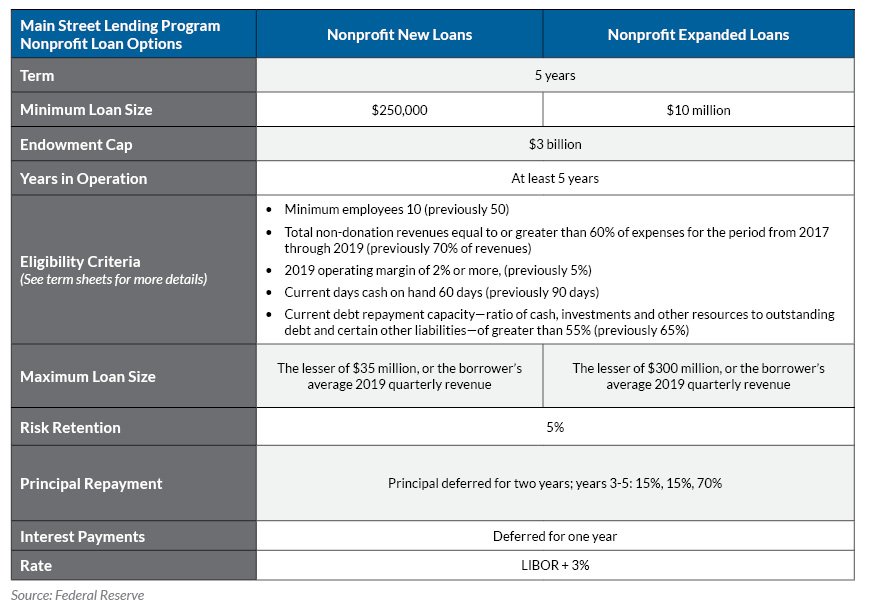

This expansion of MSLP allows nonprofit two options: take out a new loan or increase an existing loan. Most of the loan terms follow the original MSLP program. Major provisions are summarized in the below chart. Full details can be found on the term sheets published by the Fed: Nonprofit Organization Expanded Loan Facility and Nonprofit Organization New Loan Facility.

Learn more about MSLP, including the application process and loan use restrictions, in this blog post. Interested nonprofits should review the full term sheets linked above and consult with a participating lender.

RKL’s team of nonprofit advisors – the largest in the region – has been helping organizations manage operational, workforce and financial challenges throughout the pandemic crisis. Contact your RKL professional or use the form below to discuss MSLP or other needs of your organization.