The CARES Act contains many stimulus components for individuals, businesses, nonprofits and other groups. Much of the focus to date has been on shoring up the small business and nonprofit marketplace through the Paycheck Protection Program (PPP) and Economic Injury Disaster Loans (EIDL). Recognizing the limitations on size for many businesses, often for those with more than 500 employees or that fell prey to business affiliation rules, the Treasury and Federal Reserve are utilizing a component of the CARES Act to provide access to loan funding to those businesses which were left out.

The Main Street Lending Program (MSLP) is part of the broader Exchange Stabilization Fund (ESF) that has received minimal attention since the onset of the CARES Act. The MSLP component is focused on providing $600 billion of loans to small and medium-sized for profit enterprises, while other aspects of the ESF are focused on broader securities markets. On April 9, 2020, the Fed provided the following initial information on the MSLP. The Fed made significant updates to the program on April 30, 2020, and provided further guidance on May 27, 2020 and June 8, 2020. MSLP officially opened for lender registration through the program portal on June 15, 2020. Borrowers must apply with an approved lender.

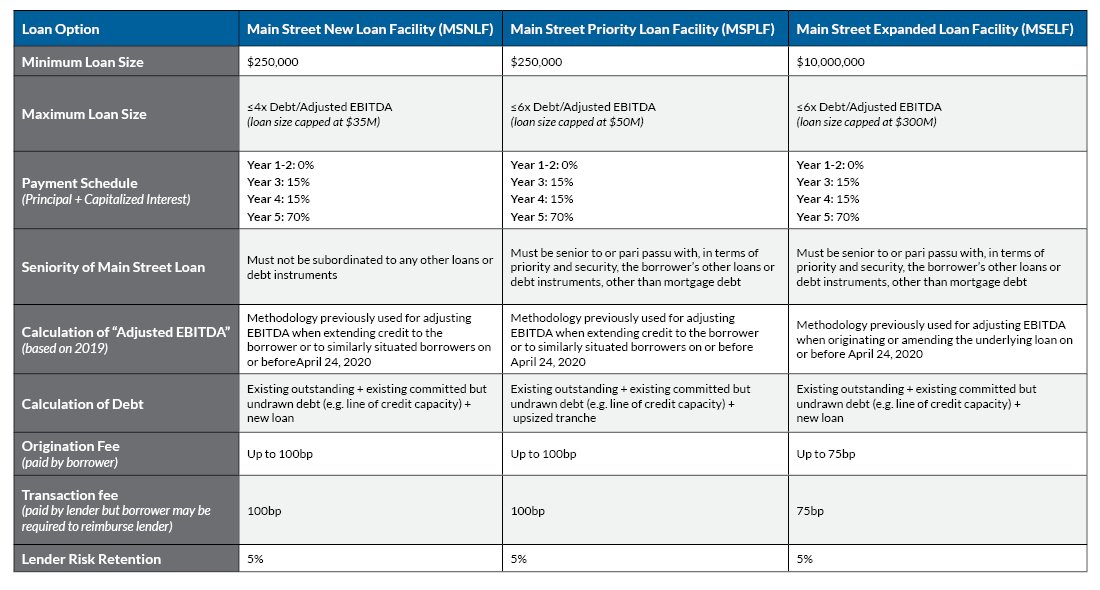

Our summary of the program follows. Interested parties are encouraged to review the expansive source documentation or consult with a participating lender.

- Available to businesses with ≤15,000 employees or ≤$5.0 billion annual revenue in 2019

- Five-year term loan, which could be secured or unsecured (MSELF could be revolver if underlying loan is a revolver)

- Two-year deferral of principal

- One-year deferral of interest; unpaid interest will be capitalized

- Rate = LIBOR (1 month or 3 month) + 3%

- Eligible lenders can originate new loans or increase the size of existing loans

- No prepayment penalty

- There is currently no asset-based underwriting metric in lieu of EBITDA

- FFIEC “pass” rating as of December 31, 2019, if applicable

- Lender must assess borrower’s financial condition and creditworthiness at the time of application, and are permitted to employ stricter underwriting criteria

- Lenders will share risk pari passu with MSLP facility; thus it appears a bank’s maximum exposure is 5% of the loan

- For the MSNLF and the MSELF, loan proceeds must not be used to repay or refinance pre-existing loans or a line of credit (proceeds may be used for mandatory principal and interest payments). For the MSPLF, proceeds may be used to refinance debt owed to lenders other than to the lender originating the MSPLF

- Existing lines of credit must remain in place (borrower and lender obligation)

- Loans may contain certain priority and/or security covenants, material misstatement certifications, cross-acceleration provisions, and financial reporting covenants

- Borrower must certify that it can meet 90 days of financial obligations and does not expect to file for bankruptcy during that time period

- Significant operations and a majority of borrower’s employees must be located in United States

- Private equity funds are ineligible but their portfolio companies may be eligible (subject to meeting other criteria, including affiliate aggregation testing)

A borrower must demonstrate that it is “unable to secure adequate credit accommodations from other banking institutions.” However, the borrower may certify that it is unable to secure “adequate credit accommodations” because the amount, price, or terms of credit available from other sources are inadequate for the borrower’s needs during the current unusual and exigent circumstances. Borrowers are not required to demonstrate that applications for credit had been denied by other lenders or otherwise document that the amount, price, or terms of credit available elsewhere are inadequate.

According to the Fed’s guidance, borrowers “should make commercially reasonable efforts to maintain payroll and retain employees” while the loan is outstanding, and must also “follow compensation, stock repurchase, and capital distribution restrictions that apply to direct loan programs under section 4003(c)(3)(a)(ii) of the CARES Act.” Pass-through entities may make necessary tax distributions. Borrowers that received a PPP loan may also take out an MSLP loan.

MSLP loans will be full recourse and will not have any forgiveness or grant component, unlike the PPP. Accordingly, most if not all eligible borrowers under the PPP will likely see that program as the better alternative, with the MSLP benefiting those businesses which were not eligible, could not access PPP funding or needed relief beyond that provided with a PPP loan.

To obtain a loan under the MSLP, a borrower must submit an application and any other documentation required by a lender to such lender. Borrowers should contact an eligible lender for more information on whether the eligible lender plans to participate in the MSLP and to request more information on the application process. An eligible lender is a U.S. federally insured depository institution (bank, savings association, or credit union), U.S. branch or agency of a foreign bank, a U.S. bank or savings and loan (S&L) holding company, a U.S. intermediate holding company of a foreign banking organization or a U.S. subsidiary of any of the foregoing.

Finally, beware that the Federal Reserve will disclose names of lenders and borrowers, amounts borrowed and interest rates charged, and overall costs, revenues and other fees.

Your RKL advisor can help you evaluate the best financing options for your business – contact them to start the conversation.