Annual updates to tax documents are generally not headline-grabbing news, but the 2020 Form W-4 released last week by the IRS is a serious departure from previous editions. From calculation methodology to employee tax withholding screens, there’s a lot that has changed. Below, we highlight the biggest areas of difference and offer important guidance for employers and employees to adapt to the new form.

Why the Change?

It all goes back to the Tax Cuts and Jobs Act (TCJA). To reflect the individual tax changes of the legislation, the IRS first released a draft update to Form W-4 in June 2018, which included nine pages of instructions. Many professional organizations and advocacy groups requested a more streamlined form. This feedback helped to inform the final W-4 just released, which only needs four pages to transmit the instructions, form, worksheets and tax tables.

What Changed?

On the whole, the new 2020 W-4 looks completely different. Here are some of the biggest changes:

- The term “Allowance” was taken out of the official form name. Why? Because the TCJA eliminated personal or dependent exemptions.

- Instead of “lines” as in previous W-4s, we now have “steps.” The steps in the 2020 W-4 are as follows:

Step 1: REQUIRED – Personal Information (name, address, social security number, filing status). The available filing statuses are: Single or Married filing separately; Married filing jointly (or Qualifying widow(er)); Head of household. These differ from 2019, which were: Single; Married; Married, but withhold at higher Single rate

Step 2: OPTIONAL – If you have multiple jobs or if your spouse works, you can complete this section.

Step 3: OPTIONAL – Complete this section if you have dependents.

Step 4: OPTIONAL – If you have any other adjustments (other income, deductions or additional withholding), you may complete this section.

Step 5: REQUIRED – Employee signature and date.

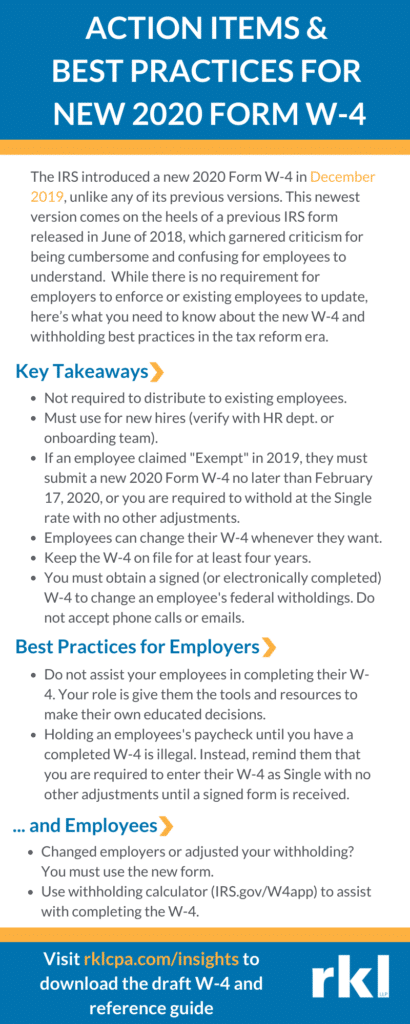

Key takeaways from the new Form W-4:

- You may request that all employees hired before 2020 submit the new 2020 Form W-4, as long you explain that they are not required to submit the new form if they are not changing their federal withholding.

- If an employee claimed “Exempt” in 2019, they must submit a new 2020 Form W-4 no later than February 17, 2020, or you are required to withhold at the Single rate with no other adjustments.

- Employees hired after December 31, 2019, must complete a 2020 W-4. Withhold at Single with no other adjustments until a completed W-4 is received.

- If an employee wants to change their withholding affecting a pay dated after December 31, 2019, they must use the 2020 Form W-4.

- Employees can change their W-4 whenever they want. The employer is required to update the withholdings by the start of the first payroll period ending the 30th day from the date received.

- Keep the W-4 on file for at least four years.

- Comply with all lock-in letters from the IRS.

- You must obtain a signed (or electronically completed) W-4 to change an employee’s federal withholdings. Do not accept phone calls or emails.

Best practices for employers:

- Call your payroll vendor to ensure they are ready for this change. With the new 2020 Form W-4 finalized on December 4, they should now have a plan in place.

- Review IRS Publication 15-T for more information on how the payroll system will calculate the federal withholding for an employee’s pay. For the first few payrolls, double-check the math for a representative sampling of your employees.

- Provide your employees with this link to help them complete their W-4.

- Do not assist your employees in completing their W-4. Your role in payroll or human resources is not to complete their form for them, but rather to give them the resources and tools to make educated decisions that make sense for their situation.

- Holding an employee’s paycheck until you have a completed W-4 is illegal. Instead, remind them that you are required to enter their W-4 as Single with no other adjustments until a signed, completed W-4 is received.

The new W-4 may cause confusion among employees, so employers should be prepared to assist and advise. RKL’s team of experts are here to guide your team through these changes and more. Contact RKL today.