Starting and owning a business is a dream for many people. However, they may not realize how much behind-the-scenes work and effort is required to turn an idea into a fully functioning entity. Fledgling entrepreneurs may find it difficult to know which tasks to prioritize, and what should be outsourced versus handled independently. For those still in the idea phase, we put together this how-to guide to help get your business off the ground.

Find Trusted Professionals

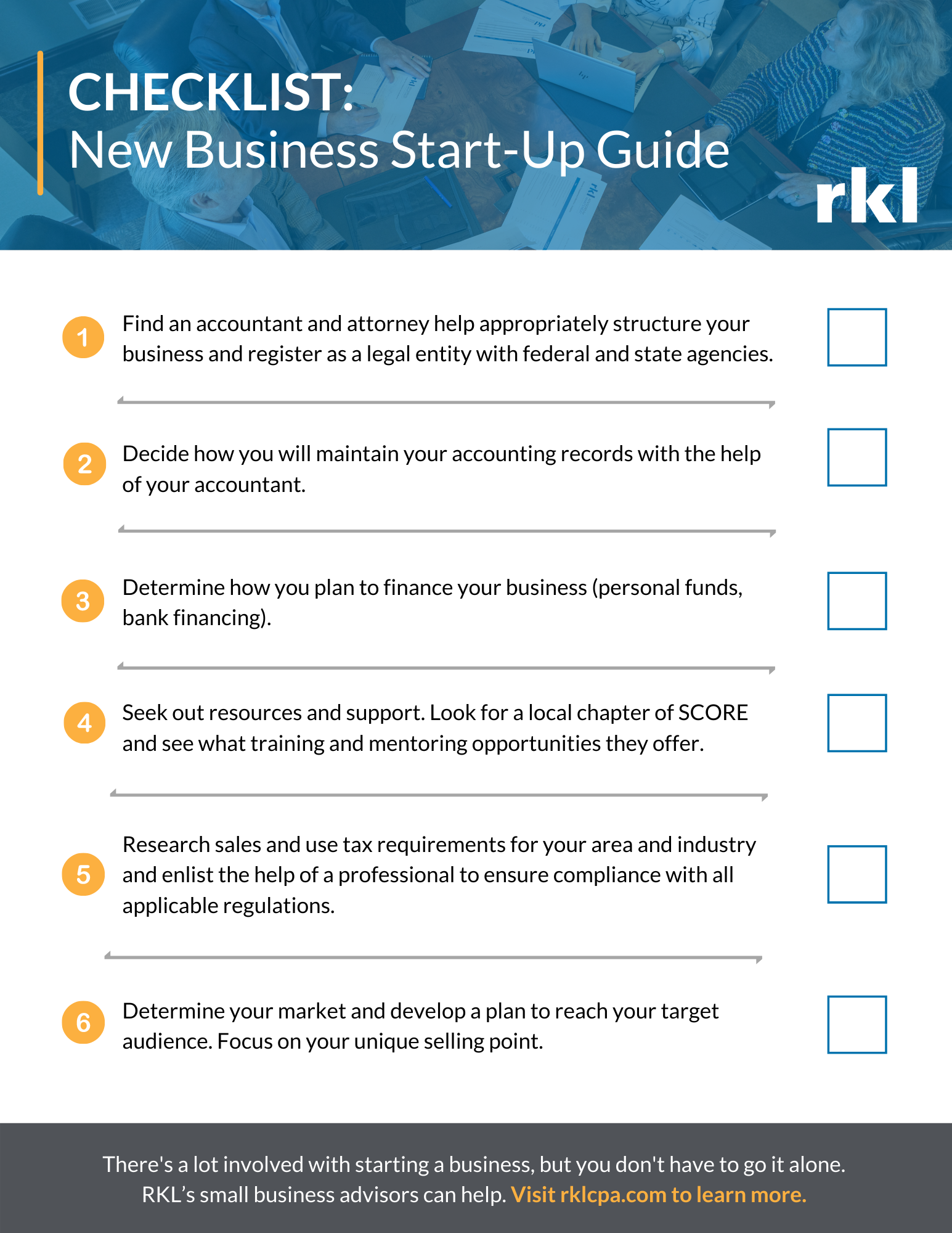

The first thing to do is find an accountant and attorney. They will provide guidance to determine the appropriate entity structure for your business and set up the business as a legal entity with the appropriate federal and state agencies. Trust these tasks to professionals instead of attempting to do them yourself, which could lead to more issues and possible fees and penalties down the line. There are a lot of intricacies involved, and having someone who knows exactly what they’re doing will save you unnecessary stress. Be sure to come prepared to these meetings with answers to some common questions, especially whether your business will have employees, as there are other complexities and factors involved with that.

Set Up Accounting Records

Decide how you will maintain your accounting records. It’s crucial to determine what needs to be maintained and develop a standard operating procedure for doing so. An accountant can help you through this process.

Determine Financing

How are you going to finance your business? Are you investing personal funds, or will you need bank financing? If you require bank financing, you’ll need to develop a business plan to present to the loan officer. There are typically local resources that offer assistance in drafting a business plan as discussed next.

Seek Out Resources and Support

Starting a new business is expensive, and many business owners don’t have extra funds to spare in the beginning. Lean on your community resources to get advice and guidance from people who have gone through the process. Many communities offer free assistance for entrepreneurs. SCORE, the nation’s largest network of volunteer, expert business mentors, has local chapters that offer resources, training and mentoring for entrepreneurs. Find your local chapter here. SCORE also offers several free templates for business owners, including ones to help you create a business plan, calculate your start-up expenses or conduct a sales analysis.

Understand Sales and Use Tax Requirements

Research sales and use tax requirements for your area and industry. Sales and use taxes also vary from state to state, so be sure you’re looking at the requirements for the states(s) where you’ll be operating. You can also meet with a state and local tax professional, like the team at RKL, to get help with this step and ensure that your business is compliant with all regulations applicable to your market and operations.

Determine Your Market

One of the most important steps of starting a business is determining your market. Who are your products or services aimed towards? What missing need will you be filling in your community? Will you have any competitors? What sets you apart? Developing a plan to reach your target audience is critical for your business to have a chance at success. Having a unique factor that sets you apart from your competitors gives you a higher chance of survival.

It’s normal to feel overwhelmed when starting a business, but you don’t have to go through it alone. RKL’s Small Business advisors provide close, personalized service to start-up business owners and entrepreneurs. Contact your RKL advisor or use the form below to start the conversation.