Credit unions now have another option to offer members quick access to funds without the high interest rates, rollovers and balloon payments that accompany traditional payday lending options. In September 2019, the National Credit Union Association (NCUA) Board approved a final rule to allow credit unions to offer a second payday alternative loan (PAL) to their members.

The NCUA authorized credit unions to begin offering this new option (referred to as PAL II) effective December 2, 2019. Credit unions may offer both the existing payday alternative loan option (PAL I) as well as PAL II; however, credit unions are only permitted to offer one type of PAL per member at any given time.

Why create a new payday alternative loan option? According to the NCUA, the intent behind PAL II is to offer a more competitive alternative to traditional payday loans, as well as to meet the needs of members that were not addressed with the existing PAL.

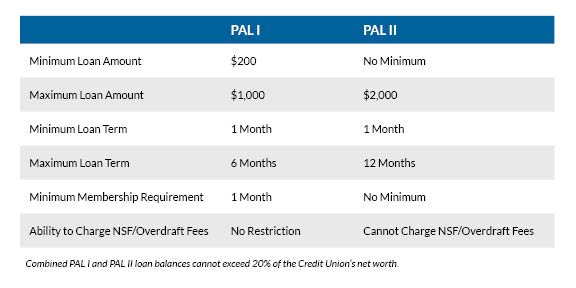

What are the key differences between these payday alternative loan types? The flexibility of the PAL II allows credit unions to offer a larger loan with a longer payback period, and eliminates the requirement for a borrower to have been a member of the credit union for one month prior to obtaining a PAL II. Key areas of difference between to the two options are summarized in the below chart.

What’s staying the same? Some features of PAL I remain unchanged for PAL II, including:

- Prohibition on application fee exceeding $20

- Maximum interest rate capped at 28% (1000 basis points above the maximum interest rate established by the NCUA Board)

- Limitation of three PALs (of any type) for one borrower during a rolling six-month period

- Required full amortization over the loan term (meaning no balloon feature)

- No loan rollovers allowed

As with PAL I loans, credit unions are required to establish minimum standards for PAL II that balance their members’ need for quick access to funds with prudent underwriting. The underwriting guideline requirements are the same for both PAL I and PAL II, which includes documentation of proof of income, among other factors.

Benefits of new payday loan option

The addition of the PAL II loan option allows greater flexibility for credit unions to assist their members with larger dollar emergencies, while sparing them the negative financial consequences of a traditional payday loan. To position members for increased economic security over the long-term, many credit unions have built financial literacy requirements and benefits into their PAL programs, including credit counseling, savings components, incentives for payroll deduction for loan payments or reporting of PAL payments to credit bureaus to boost member creditworthiness.

Action items

Credit unions should evaluate this new loan option and decide if it is a good fit for their members. A credit union that decides to move forward must update its loan policy before offering PAL II loans. Otherwise, they may be exposed to regulatory risk and scrutiny. A credit union’s board of directors must also approve the decision to offer PAL II.

RKL’s team of credit union advisors can help your credit union properly plan for and implement PAL II as a new loan product offering and ensure regulatory compliance. Contact us today using the form at the bottom of this page and learn more about the many ways we serve the compliance, regulatory and advisory needs of financial institutions throughout the Mid-Atlantic.