Editor’s note: For a comprehensive guide to all four pandemic relief acts, download the COVID-19 Relief Summary for Employers, which tracks the evolution of certain provisions and introduces new benefits.

Is your organization taking advantage of coronavirus relief measures? If so, it is critical to follow proper protocol in order to receive the most robust funding possible from the variety of new tax credits available to employers. Use the below guide as a reference to the details of various provisions and how to apply for reimbursement.

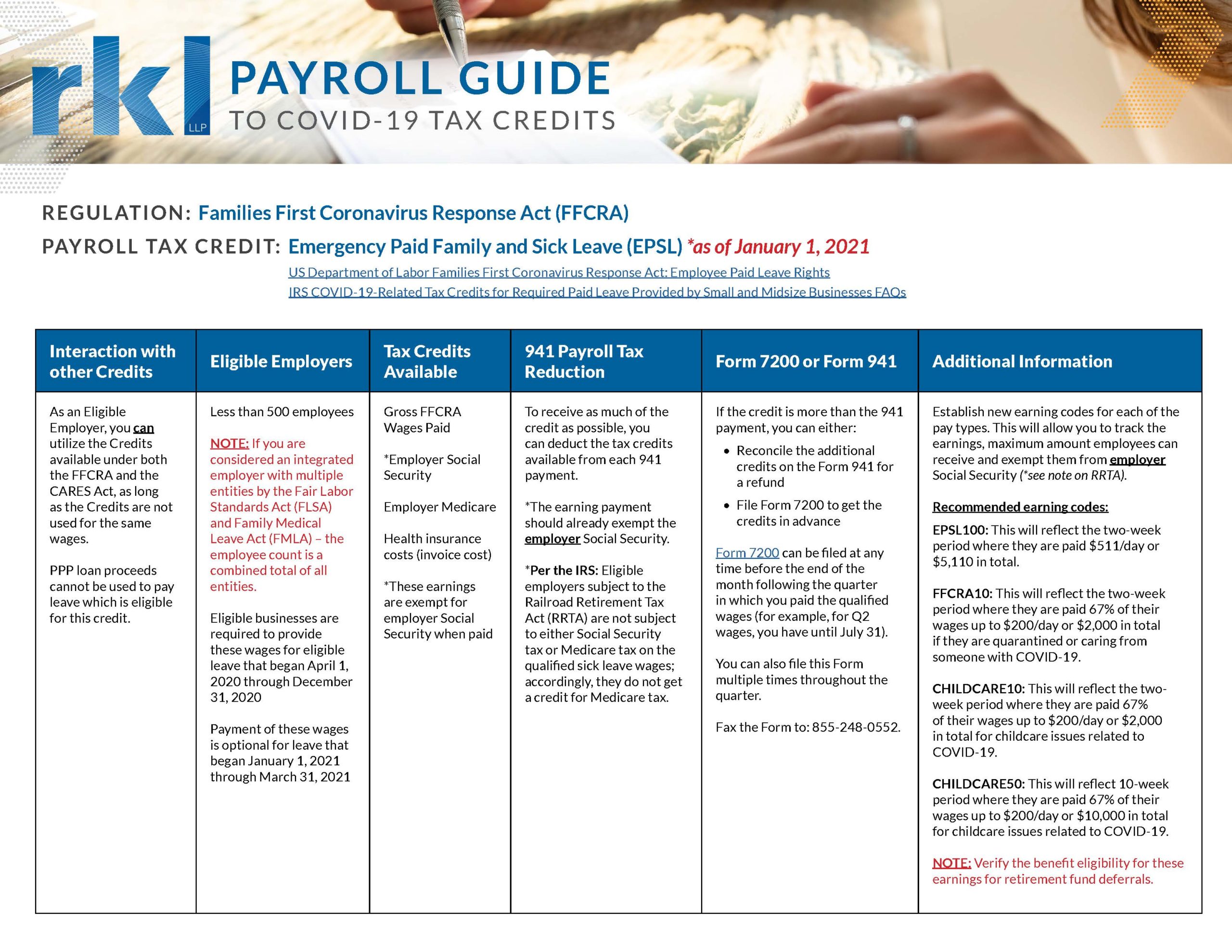

(Click here to download/enlarge)

RKL has a deep bench of payroll advisors that can help organizations properly track wages, apply tax credits and amend IRS forms as needed. Contact your RKL advisor or reach out using the form below. Visit RKL’s Coronavirus Resource Center for more guidance and insights.