Between the Families First Coronavirus Response Act (FFCRA) and the Coronavirus Aid, Relief and Economic Security (CARES) Act, there are a number of new tax credits available to provide support and assistance to employers during the pandemic.

To receive the maximum relief, employers must track wages and leave properly and complete the necessary IRS forms. This level of documentation and reporting requires clear and continuous communication between organizations and their payroll providers, whether in-house or third-party.

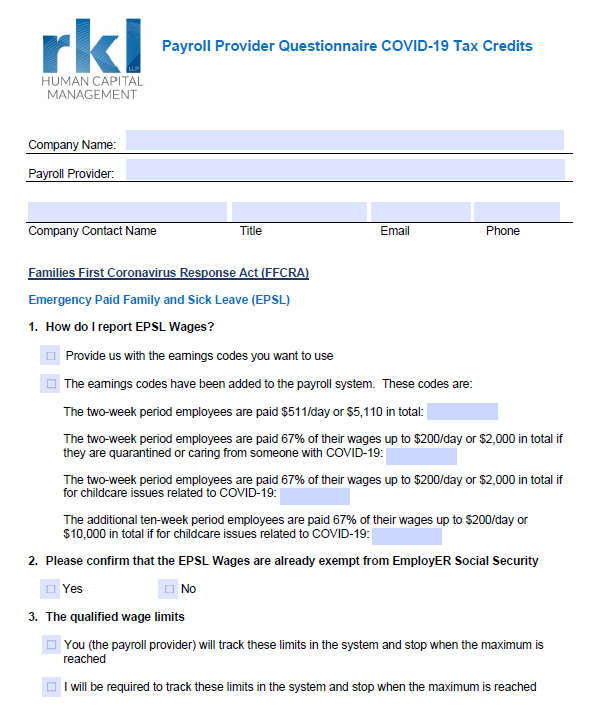

RKL Human Capital Management and Small Business Services Group developed the below guide to help employers and payroll providers get on the same page regarding key questions like:

- What is your payroll provider doing/not doing (Form 7200 and 941)?

- Are they reducing 941 payments for available credits?

- How are they handling the payroll tax deferral?

- How are they accounting for health insurance?

- Will they adjust the 941 for the Form(s) 7200 you file?

- Will they add the Q1 2020 credits to the Q2 941?

(Click here to download)

Contact your RKL advisor or use the form below to reach out with questions related to this form or the tax credits in general. Find more guidance and insights in our Business Recovery Resource Center.