Editor’s notes:

- On June 17, 2020, SBA and Treasury released an update to its standard forgiveness application to reflect program changes under the PPP Flexibility Act, as well as a new EZ application. Read more about the applications here.

- On June 5, 2020, the PPP Flexibility Act was signed into law. The legislation eases the rules around use of PPP funds and forgiveness eligibility. The below information remains valid since there is now an optional inclusion of the new terms. Find a summary of the PPP Flexibility Act here.

Now that small businesses and organizations have received Paycheck Protection Program (PPP) funding, with more to come from the PPP Refill, attention has turned to the next and most vital phase: loan forgiveness. If borrowed funds are spent as intended on payroll, mortgage interest, rent and utilities in the eight weeks after receipt, those expenditures are potentially eligible for complete, tax-free forgiveness.

Just like the PPP application process, the calculation of forgiveness amount contains regulatory ambiguities sure to create confusion among borrowers and their advisors. Below, we outline what is relatively clear based on available Small Business Administration (SBA) guidance at the time of this writing, what remains unclear and what applicants can do in the meantime to get positioned for maximum forgiveness. We will update this post as more information becomes available.

It is essential for borrowers to remain in constant communication with their lender throughout the covered period to ensure compliance with that specific bank’s interpretation and application of SBA PPP forgiveness guidance.

What we (think) we know

Eligible costs

PPP loans offer a potential for the entire loan to be forgiven, tax-free. To be eligible for forgiveness, the loan proceeds must be used for:

- Payroll costs

- Covered mortgage obligations: payments of interest (not including any prepayment or payment of principal) on any business mortgage obligation on real or personal property incurred before February 15, 2020

- Covered rent obligations: business rent or lease payments pursuant to lease agreements for real or personal property in force before February 15, 2020

- Covered utility payments: business payments for a service for the distribution of electricity, gas, water, transportation, telephone, or internet access for which service began before February 15, 2020

- Transportation costs we qualified to only include “transportation utility fees.”

Payroll costs include:

- Cash Compensation: gross salary, gross wages, gross tips, gross commissions, bonuses, paid leave (vacation, family, medical or sick leave, not including leave covered by the Families First Coronavirus Response Act), and allowances for dismissal or separation paid or incurred during the Covered Period or the Alternative Payroll Covered Period (as subsequently defined)

- The above definition is contained in the loan forgiveness application. The Interim Final Rule on Loan Forgiveness (issued May 22, 2020) also denoted bonuses and hazard pay as part of cash compensation. Additionally, FAQ 32, in response to a question about housing stipends and allowances, stated that “Payroll costs includes all cash compensation paid to employees, subject to the $100,000 annual compensation per employee limitation.” Therefore, other forms of compensation paid in cash to employees during the covered period could be deemed as cash compensation.

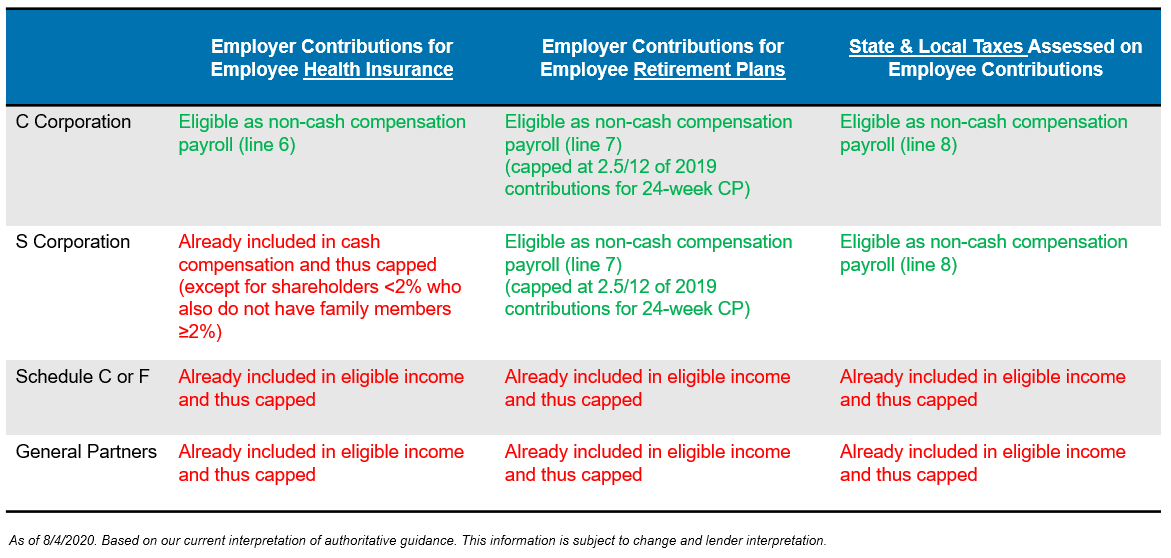

- Employer contributions for employee health insurance

- Employer contributions to employee retirement plans

- Employer state and local taxes assessed on employee compensation

Payment specifically excluded from forgiveness includes the following:

- Cash compensation in excess of $100,000 for an individual employee or self-employment income of a partner in a partnership

- Compensation to an employee with a principal residence outside of the United States

- Qualified sick or family leave wages under the Families First Coronavirus Response Act

- Prepayment for expenses

The $15,385 cash compensation cap was revised for the new 24-week covered period, and there are different figures for owners versus non-owners:

- Non-owners: Prorated portion of $100,000 cash compensation is $46,154 (24/52 x 100,000) for a 24-week covered period; eight-week proration remains at $15,385.

- Owners (includes “owner-employees, a self-employed individual, or general partners” and is presumed to include C Corp and S Corp shareholders and independent contractors, as well): Prorated portion of $100,000 cash compensation is $20,833 (2.5/12 x 100,000) for a 24-week covered period. This is the cap for eligible owner comp and it is also subject to 2.5/12 of 2019 compensation if this amount is lower. The eight-week proration remains at the lesser of: $15,385 or 8/52 of 2019 compensation.

- C-corporation owner-employees are capped by the amount of their 2019 employee cash compensation and employer retirement and health insurance contributions made on their behalf.

- S-corporation owner-employees are capped by the amount of their 2019 employee cash compensation and employer retirement contributions made on their behalf, but employer health insurance contributions made on their behalf cannot be separately added because those payments are already included in their employee cash compensation.

- Schedule C or F filers are capped by the amount of their owner compensation replacement, calculated based on 2019 net profit.

- General partners are capped by the amount of their 2019 net earnings from self-employment (reduced by claimed section 179 expense deduction, unreimbursed partnership expenses, and depletion from oil and gas properties) multiplied by 0.9235.

The following table summarizes the nuances of what is included in cash compensation for various owner types.

Alternative Payroll Covered Period

The SBA’s loan forgiveness application now includes an Alternative Payroll Covered Period, which is meant to have the eight-week period correspond with a company’s normal payroll cycle and not require a “special” payroll to be run. The Alternative Payroll Covered Period is open to borrowers with biweekly or more frequent payroll. They may elect to calculate payroll costs beginning on the first day of their first pay period following their PPP loan. For example, if the disbursement date occurred on Monday, April 20 and next pay period starts on Sunday, April 26, then April 26 is the starting point for the 56 days for payroll costs. In this case, June 20 would be the 56th day in the eight-week period. If electing to use the Alternative Payroll Covered Period, borrowers must apply it consistently throughout the application whenever the application references use of the Alternative Payroll Covered Period.

Incurred OR paid

In addition to the Alternative Payroll Covered Period, the application removes some other administrative challenges, such as allowing companies to pay their final payroll for whichever eight-week covered period they elect on their next regular payroll date. Similarly, eligible non-payroll costs incurred during the eight-week period may be paid on or before the next regular billing date, even if that date is after the eight-week covered period.

Apart from the administrative timing, the application appears to theoretically widen the 56-day period by focusing more on costs that were paid in the covered period rather than those that were both incurred and paid. This opens up the payment of eligible expenses that were accrued or deferred at the onset of the eight-week covered period, such as unpaid utilities, mortgage interest which was subject to forbearance and accrued rents. While not specifically addressed, it may also consider back pay or accrued expenses at the time of disbursement which were later paid during the covered period as eligible for forgiveness. However, any prepayment of mortgage interest or accelerated payments of health care or retirement expenses are ineligible for forgiveness.

We expect this issue to be further clarified. If taken at its most liberal interpretation, this concept could be especially borrower friendly.

Loan forgiveness haircuts

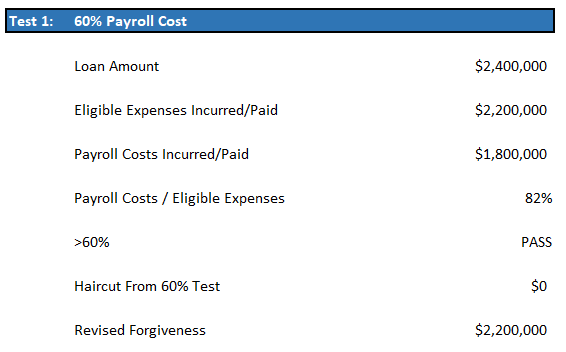

Additionally, loan forgiveness is predicated on how the loan proceeds are utilized over an eight-week period beginning on the date the lender makes the disbursement of the loan (or for the Alternative Payroll Covered Period). The lender is required to make the disbursement within 10 days of the SBA’s loan approval. Once these funds are disbursed, in order to qualify for loan forgiveness, 60 percent of the forgiveness amount (based on the loan forgiveness application) must be spent on payroll costs. The remaining 40 percent may be utilized for covered mortgage obligations, covered rent obligations and covered utility payments, as discussed above.

So let’s say XYZ Co. receives a loan on April 13 for $2.4 million and by June 7, the eight-week period, the company has spent $2.2 million of the proceeds on eligible items, of which $1.8 million was spent on payroll costs and the remainder was spent on mortgage interest, rent and utilities. Since at least 60 percent was spent on payroll costs, the entire $2.2 million spent would be eligible for loan forgiveness pending the outcome of the next two haircut tests.

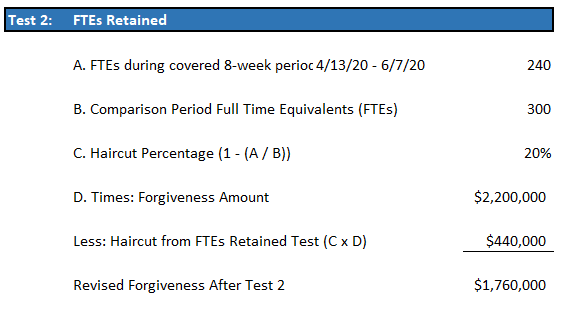

After an employer calculates its spending over the eight-week period, there are two more haircut tests which may reduce the amount of loan forgiveness. First, we must compare the average full-time equivalent employees (FTEs) during the eight-week period to the average FTEs from February 15, 2019 through June 30, 2019, or January 1, 2020 through February 29, 2020, depending on seasonality.

XYZ Co. averages 240 FTEs from April 13, 2020 through June 7, 2020. XYZ Co. had 300 FTEs during the comparison period from 2019 and 320 during the 2020 comparison period. The 2019 comparison period is used in this example since it is the lower amount. Therefore, 20 percent of the $2.2 million calculated above is not eligible for forgiveness, ((300-240)/300=20%)). XYZ Co. is now eligible for loan forgiveness on $1.76 million ($2.2M-($2.2Mx20%)).

On May 3, 2020, the Treasury and SBA released guidance that eased the FTE haircut on employers which make a good faith, written offer to rehire an employee at prior wage and hour levels, to which the employee rejects. Previously, employers were concerned about failing this haircut test due to unwilling or unable employees electing to not be rehired, therefore reducing the FTEs during the covered period. If not replaced, these employees get counted in this haircut test. Importantly, if an employee rejects such an offer, the employee forfeits eligibility for continued unemployment compensation. There are similar exceptions in the forgiveness application for employees who (a) were fired for cause, (b) voluntarily resigned, or (c) voluntarily requested and received a reduction of their hours.

On May 3, 2020, the Treasury and SBA released guidance that eased the FTE haircut on employers which make a good faith, written offer to rehire an employee at prior wage and hour levels, to which the employee rejects. Previously, employers were concerned about failing this haircut test due to unwilling or unable employees electing to not be rehired, therefore reducing the FTEs during the covered period. If not replaced, these employees get counted in this haircut test. Importantly, if an employee rejects such an offer, the employee forfeits eligibility for continued unemployment compensation. There are similar exceptions in the forgiveness application for employees who (a) were fired for cause, (b) voluntarily resigned, or (c) voluntarily requested and received a reduction of their hours.

Under the third test, we must analyze whether there has been a more than 25 percent reduction in average salary and/or wages for each employee (individually) from the eight-week covered period in comparison to pay during the first quarter of 2020. This is a significant change to the original interpretation of guidance that suggested a comparison of two time periods that did not arithmetically align.

If salaries/wages for any individual employee were reduced by more than 25 percent, the difference between 75 percent of the average annual salary or wage rate in the first quarter of 2020 and the average annual salary or wage rate in the covered period is calculated and multiplied by the employee’s average weekly hours during the first quarter of 2020. Mathematically, the result is then reduced by any reductions for the FTE haircut and the 75 percent of forgiveness is payroll tests.

It is also important to note that this third test only applies to employees who received compensation from the borrower at an annualized rate on each pay period in 2019 that was less than or equal to $100,000.

For example, Employee F has an annual base salary of $52,000. However, Employee F earned an annual bonus of $3,000 which was paid in the last week of December. While Employee F’s total cash compensation in 2019 was $55,000, Employee F’s weekly pay in the last week of December was $6,000, which is $208,000 annualized. Thus Employee F is not included in the salary haircut test.

Based on the CARES Act, and the “safe harbors” contained in the forgiveness application, there is a provision for rehiring which may negate the impact of tests two and three in our example if:

- Elimination of the reduction from the FTEs retained test (test 2): Any reduction to FTEs was made from February 15, 2020 through April 26, 2020, and the FTE count was restored to February 15, 2020 levels on or before December 31, 2020 or the date the application is submitted; or

- Elimination of the reduction from the cash compensation reductions test (test 3): Any reduction to salaries or wages of one or more employees was made from February 15, 2020 through April 26, 2020, and the reduction was eliminated by December 31, 2020, or the date the application is submitted, to February 15, 2020 levels; or

- Elimination of the reductions from both tests 2 and 3: Rectify reductions in both FTEs and salaries/wages per the above.

Finally, for borrowers that did not make any salary/wage reductions in excess of 25% and which meet the criteria for an inability to return to the same level of business activity as before February 15, 2020 due to HHS, CDC or OSHA guidance or from state mandates which relied on such guidance (which we believe will apply to borrowers in many states in the Mid-Atlantic region, including Pennsylvania), the borrower can waive the FTE and salary reduction haircuts and utilize the EZ application.

These provisions eliminate the forgiveness reductions from the haircut tests but it does not automatically provide for forgiveness above and beyond eligible expenses incurred/paid, and still is subject to the 60 percent payroll test. In other words, you may not restore FTEs and salaries and expect full forgiveness without incurring the requisite eligible expenses, particularly payroll costs.

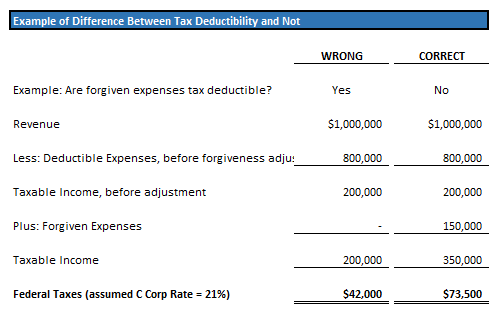

Tax deductibility of forgiven expenses

The CARES Act addressed the fact that loan forgiveness would not constitute taxable income; however, it was silent on whether or not the forgiven expenses would still be permitted deductions for federal tax purposes. On April 30, 2020, the IRS released guidance stating that forgiven expenses would not be tax deductible. The below example presents a comparison of federal taxes when forgiven expenses are deductible vs non-deductible. Of note, there is congressional pushback on this issue as the IRS’ ruling allegedly goes against congressional intent. This is certainly subject to change.

What’s still unclear

Even with interim guidance to date, there are still many unanswered questions and ambiguity surrounding the forgiveness process, including but not limited to:

- May employers furlough or lay off their employees after the end of their covered periods if they are still shut down or operating below capacity?

- The second certification on the application (funds used for unauthorized purposes) does not reference forgiveness so it appears to relate to the loan portion. Is a borrower supposed to sit on non-forgiven proceeds to complete this item then only use the remaining loan after the covered period? What if the borrower accelerated the use of proceeds that would otherwise be permitted to become a loan? Is the borrower subject to recovery or loan amounts and/or civil or criminal fraud charges?

- Just how far can owners take the incurred or paid concept? Will they be permitted to cover eligible amounts which were deferred as of the start of their covered period then paid within the covered period?

- Are owners considered employees for certain FTE calculations?

- Can a business increase its headcount to achieve maximum forgiveness?

- With respect to the owner’s compensation being capped at 2019 levels, is there any prohibition on a pay increase to the owner’s actively employed spouse or other relatives?

- How will related party rentals to be treated for purposes of loan forgiveness granted for rental payments? Will there be any specific rules in order to prevent retroactively increasing related party rents?

- Will action be taken to overrule the IRS’ ruling that forgivable expenses are not tax deductible?

- Will there be any adjustments if business owners received funds prior to having clear rules on appropriate ways to use these funds?

- How will each bank interpret and apply any conflicting or silent guidance from SBA?

- For borrowers with loans of greater than $2,000,000, what are some examples of “individual facts” that support the borrower having financial need and a lack of sources of liquidity? Where is the line drawn? Do actual results post-application matter?

- What other changes will come as a result of further stimulus packages?

What you can do now

Despite the outstanding questions, PPP loan recipients should keep records to document how proceeds are spent to provide to the bank for loan forgiveness determinations. It is important to set up general ledger tracking mechanisms and be ready to prove how the loan proceeds were spent. Borrowers may also want to consider establishing a bank account that is only used to fund eligible expenses (though opening a bank account on short notice may not be necessary or viable in the current environment).

RKL’s team of business advisors is available to help clients with loan projections and cash flow forecasting to ensure maximum PPP loan forgiveness and longer-term planning. Contact your RKL advisor to get started and check back to this post for updates as they become available. PPP borrowers should also remain in constant contact with their lenders throughout the covered period to ensure compliance.