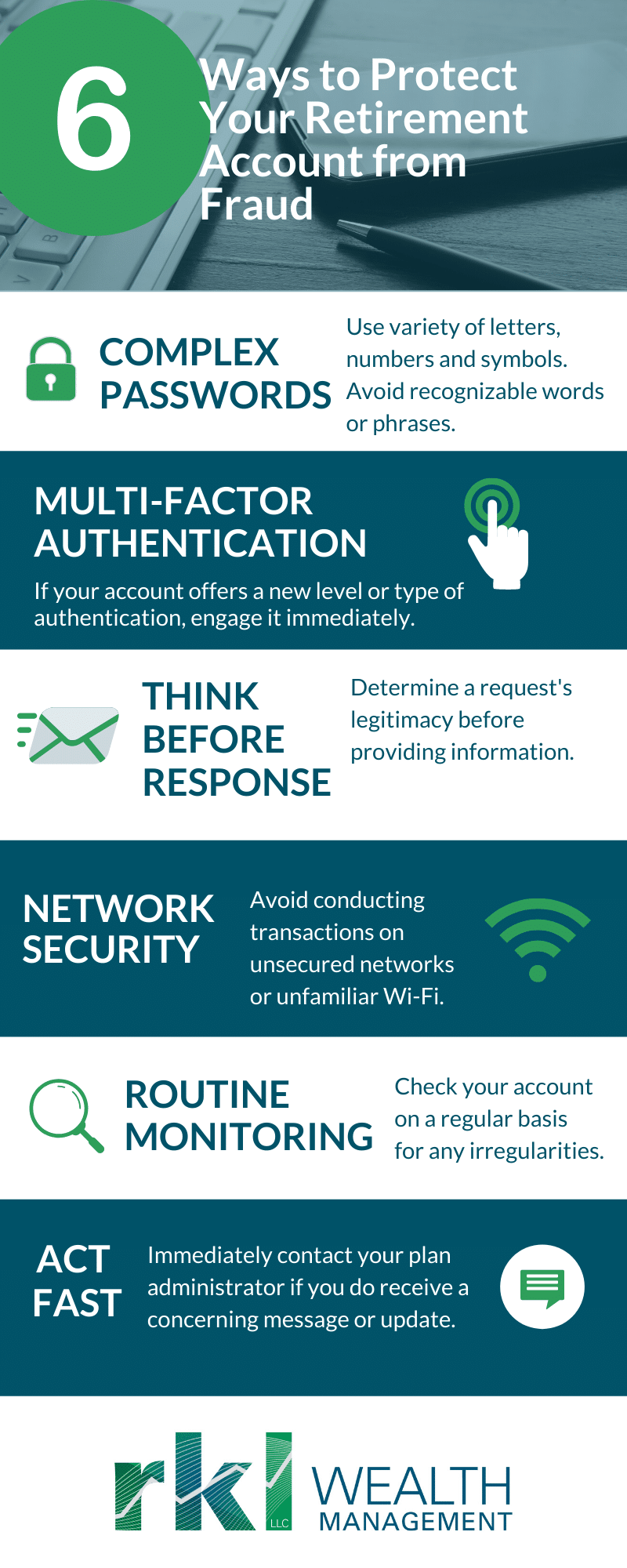

There are a lot of things to keep in mind when growing your retirement funds, like time horizon, contribution rate and investment mix. Another important factor for savers is account security. While plan providers and administrators have technology and protocol in place to defend against hackers and fraudsters, vigilance on the part of accounts owners is equally essential. Use the tips below to help ensure the security of your retirement savings accounts.

- Multi-factor authentication: Use multiple levels of security and authentication – if your plan’s record-keeper comes out with a new level/type of authentication, engage it immediately.

- Complex passwords: Do use letters, capitalization, numbers and symbols to create a strong password. Do create a password at least 14 characters in length. Do consider changing your password on a frequent basis. Don’t use recognizable words or the same password for multiple purposes.

- Think before you respond: Fraudsters may use phony calls or emails to extract account info or personal data that can be used to access your account. Don’t provide any information and contact your administrator to determine the authenticity of such requests.

- Network security: Mobile apps and online portals make it easy to access retirement accounts on the go, but be wary of conducting financial transactions on unsecured networks or unfamiliar Wi-Fi.

- Routine monitoring: Check your retirement account on a regular basis for any irregularities.

- Act fast: If you do receive a concerning message or update about your account, immediately contact your plan administrator and/or the record-keeper.