Here’s the bad news: Some deals fall apart despite the best intentions of buyer and seller. The good news? There are several practical steps business owners can take to increase the chances of closing a successful transaction, including commissioning a sell-side quality of earnings (QoE) report. Read on for an overview of QoE reports and more context around their importance from a seller’s perspective and interests.

What is a quality of earnings report?

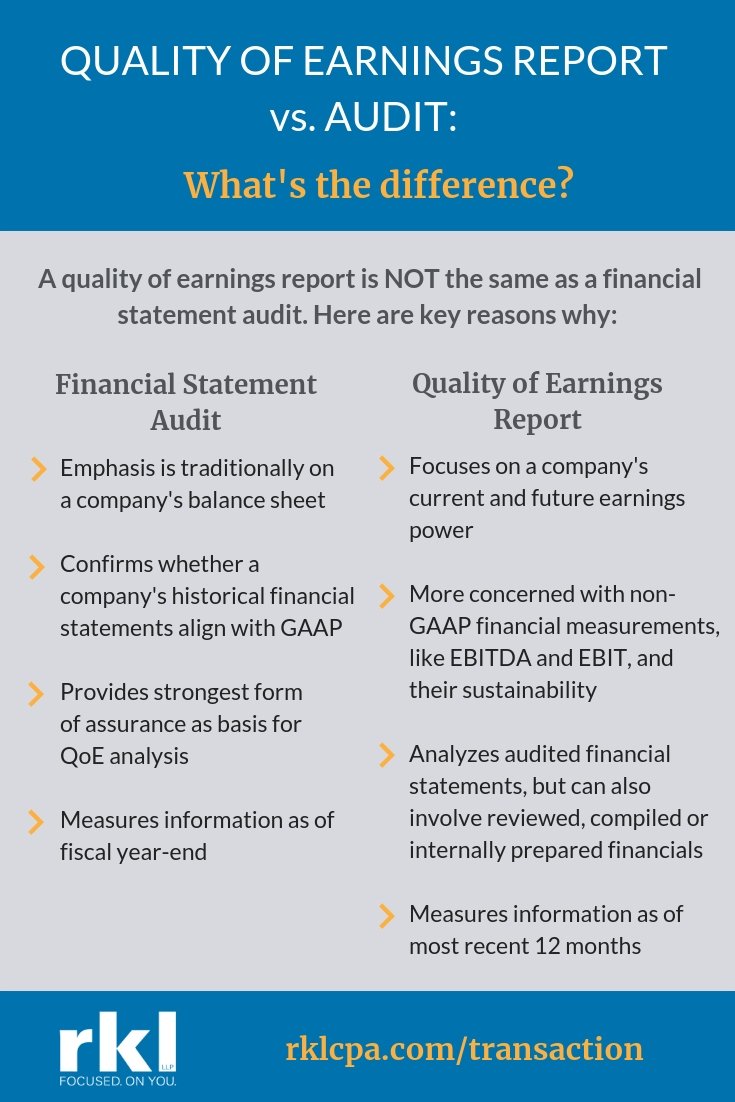

As a component of financial due diligence, QoE reports have been around for many years but have traditionally been executed by the buyer and their deal team in order to evaluate a potential transaction target. A QoE report is typically conducted by a team of finance and accounting professionals and can range in depth and breadth. Ultimately, the scope of the QoE depends upon the magnitude and complexity of the transaction. The following components are often the primary areas of focus:

- Determining adjusted earnings before interest, tax, depreciation and amortization (EBITDA) or other metric, such as earnings before interest and taxes (EBIT), particularly the validity and rationale for normalization adjustments proposed by the seller

- Establishing a target (or “peg”) level of net working capital

- Assessing revenue and profitability on a segment or customer basis

Due diligence scrutiny and effort on the rise

In recent years, the mergers and acquisitions (M&A) market has seen a rise in the level of scrutiny and effort in buyer’s due diligence. As both strategic and financial buyers look to identify high-quality targets, they are investing more effort into due diligence to be certain that the financial “story” presented by the seller resembles economic reality. A QoE report is often an integral component of overall financial due diligence.

This increased level of buyer’s due diligence has led to two primary issues for those looking to sell their business:

- Greater odds that the deal may fail altogether, or

- The deal may close, but items discovered during the buyer’s due diligence have resulted in a final transaction price or terms that are worse than what was desired.

Advantages of sell-side quality of earnings reports

To counter these negative outcomes, sellers and their advisors have been looking for additional ways to improve their chances of a successful transaction. By looking across the table at the traditional protocols and procedures guiding the buy-side, sellers have discovered the benefit of proactively commissioning sell-side QoE reports as part of their comprehensive plan to market the company for sale. A sell-side QoE report gives the seller many advantages, among them:

- Enhanced, upfront credibility among possible buyers based on having engaged an independent review and analysis of the presented financial information

- Better preparation for the due diligence period of the M&A process

- Fewer surprises during due diligence and a more expedient process

- Agreed-upon terms that withstand buyer due diligence

It is well known in M&A transactions that the advantage shifts from the seller to the buyer the moment that a letter of intent (LOI) is signed. At this juncture, the seller has closed off dialogue with other suitors to honor the period of exclusivity with its selected transaction partner. Likewise, the seller is now expected to provide (reasonably) unrestricted access to its accounting and financial records for scrutiny under the buyer’s due diligence period. These factors give the buyers increased leverage as the fate of the deal is ultimately in their hands.

By engaging an advisor to conduct a sell-side QoE, the seller can exert maximum control and ensure they put their best foot forward. In conjunction with the efforts of the seller’s deal advisors, the QoE report can be a powerful tool to supplement and support the various marketing materials circulated among potential transaction partners. The end result is a more prepared seller and a more confident buyer.

Seeking a trusted transaction advisor? Look no further than RKL.

QoE reports are highly specialized products that should be performed by dedicated due diligence professionals, like the transaction advisory team at RKL. As the saying goes, “you only have one chance to sell your business…do it right.” RKL abides by this mantra, so our advisors craft a package of transaction advisory services that meets the unique needs of sellers or buyers. Contact RKL’s Transaction Advisory Services team to gain a competitive advantage in planning and executing your next transaction.