At the height of the COVID-19 pandemic, the U.S. government rolled out a number of initiatives to help struggling business owners. One of these was the Employee Retention Tax Credit (ERTC). This refundable payroll tax credit was designed to incentivize businesses to keep employees on payroll despite the operational and financial impacts of COVID-19 restrictions. The ERTC program ran from March 13, 2020 through September 30, 2021, but employers have three years from the date of their original quarterly payroll tax (Form 941) filed during an affected period to file an amended return (Form 941x) and claim the credit.

However, certain tax credit companies have started reaching out to owners with clever marketing ploys claiming their businesses are due millions in ERTC dollars. To help you understand your eligibility, we break down the ERTC, eligibility requirements and questions to ask when talking to these tax credit companies.

Dubious ERTC Claims

There have been several rule changes and program modifications to ERTC since its introduction in March 2020, including an expanded tax credit amount and wider eligibility. However, the current state of the program is difficult to track due to vague scenarios and nuances laid out by the IRS. This has created an opening for tax credit companies to take an aggressive interpretation to ERTC eligibility and reach out to vulnerable (and confused) employers.

If you have been contacted by one of these tax credit companies claiming you’re eligible for a large sum of money, this breakdown of eligibility requirements and common ERTC myths can help you assess the truthfulness of their claims.

ERTC Eligibility

The major test for ERTC eligibility is an “either/ or” scenario. Your business can qualify either by meeting the gross receipts reduction criteria, or the full or partial suspension of operations criteria.

Gross Receipts Test

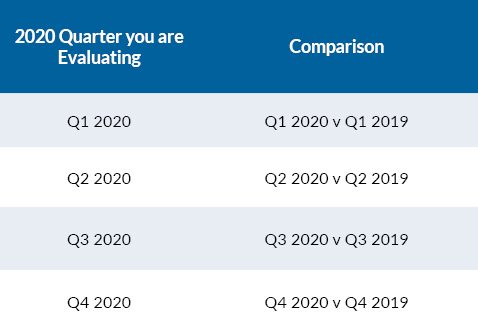

For 2020, you may qualify for ERTC for any quarter in which your quarterly gross receipts were 50 percent or less than the quarterly gross receipts from the same quarter in 2019. If you meet this requirement, you remain eligible until the first day following the quarter that has gross receipts greater than 80 percent of the same quarter in 2019.

For 2021, you had to have experienced a gross receipts reduction of at least 20 percent when using one of the two comparison methodologies below.

Gross receipts should be determined on a calendar quarter basis using the same methodology as your company’s financial return. Employers must remove Paycheck Protection Program loans, Shuttered Venue Operator grants and Restaurant Revitalization Fund grants from gross receipts figures.

Full or Partial Suspension of Operations

Under this test, you must prove the following:

- Business operations were completely or partially suspended for a period of time in 2020 or 2021 due to a government order related to COVID-19. Suspensions due to company choice (i.e., choosing to close to protect employees or in response to decreased demand) do not qualify your business for ERTC.

- If your business was partially suspended (i.e., one or more services were limited), the service(s) had to have made up a nominal portion of your operations. A nominal portion of operations is defined as least 10 percent of revenue or employee hours in the same quarter for 2019.

- Your business experienced a more than nominal impact due to the shutdown, limitation or suspension.

ERTC Eligibility Myths

When it comes to ERTC eligibility, there are several common misconceptions that may lead to shaky credit claims. Here are some of the most popular myths, and the truth behind them.

“We qualify for ERTC because employees had to wear masks in the workplace.”

Busted: A mask requirement does not mean your business experienced a partial or full suspension of operations, unless you can prove that it had a more than nominal impact to your business.

“We qualify for ERTC because our supply chain was disrupted.”

Busted: In order to qualify under this scenario, the disruption must have resulted from a government order that impacted the supplier’s ability to deliver critical goods. You must also prove that your business was unable to buy those goods from a different supplier and that you experienced a greater than nominal effect.

“All safety recommendations or guidelines a government agency issues should be considered a government orders to suspend operation requirements.”

Busted: Government orders are defined as orders, proclamations and decrees from federal, state or local governments that have jurisdiction over the business operations. COVID restrictions on businesses were issued at the state or local government level. There were no federal orders given during 2020 or 2021 that would qualify businesses for ERTC.

Questions to Ask Tax Credit Companies

If you’ve been approached by a firm claiming your business is eligible for ERTC, there is no harm in having a conversation to learn how they determined your eligibility and credit amount. However, you should go into the meeting prepared. If something sounds too good to be true, it probably is. Ask questions like:

- Will you support me in the case of an audit? Will you put in writing that you will support me and what that support will entail?

- What specific government order are you using to qualify me?

- Will you be preparing the 941-X?

While a large tax credit is an enticing prospect, be sure that your business actually qualifies so you aren’t liable come audit time. RKL’s team of tax experts can help you determine your eligibility. Reach out to your RKL advisor or use the form below to contact us.