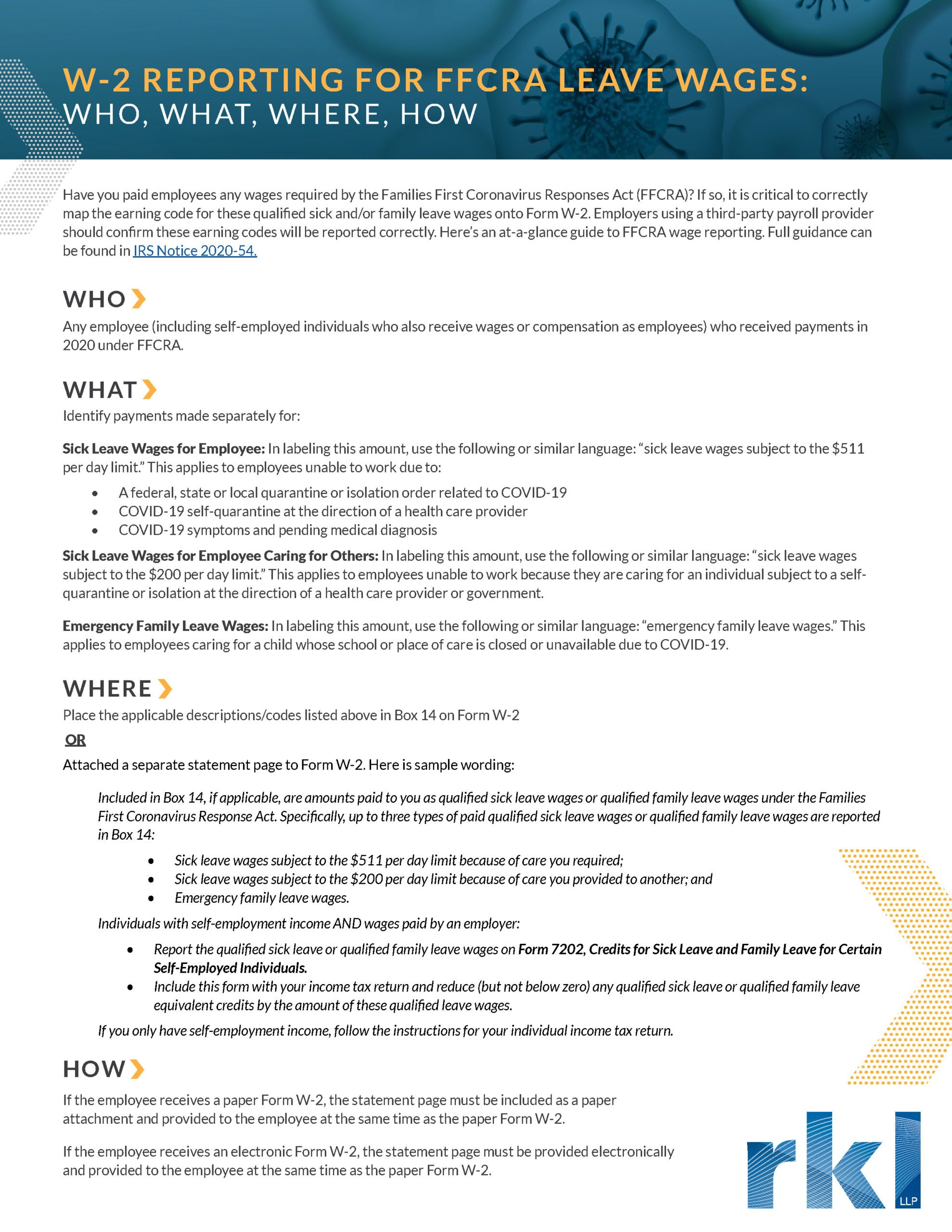

Have you paid employees any wages required by the Families First Coronavirus Responses Act (FFCRA)? If so, it is critical to correctly map the earning code for these qualified sick and/or family leave wages onto Form W-2. Employers using a third-party payroll provider should confirm these earning codes will be reported correctly. Here’s an at-a-glance guide to FFCRA wage reporting. Full guidance can be found in IRS Notice 2020-54.

(Click here to download)

Contact your RKL advisor or use the form below to reach out with questions related to W-2 reporting. Find more guidance and insights in our Business Recovery Resource Center.