There’s been a lot of talk since December 2017 about how the Tax Cuts and Jobs Act (TCJA) will affect business and personal income, but what about the impact on business valuation? Do the new tax law changes mean that businesses are now more valuable? To even begin to answer this, we need to first consider the fundamentals of business valuation and the general effects of taxation on valuation.

Business Valuation Fundamentals

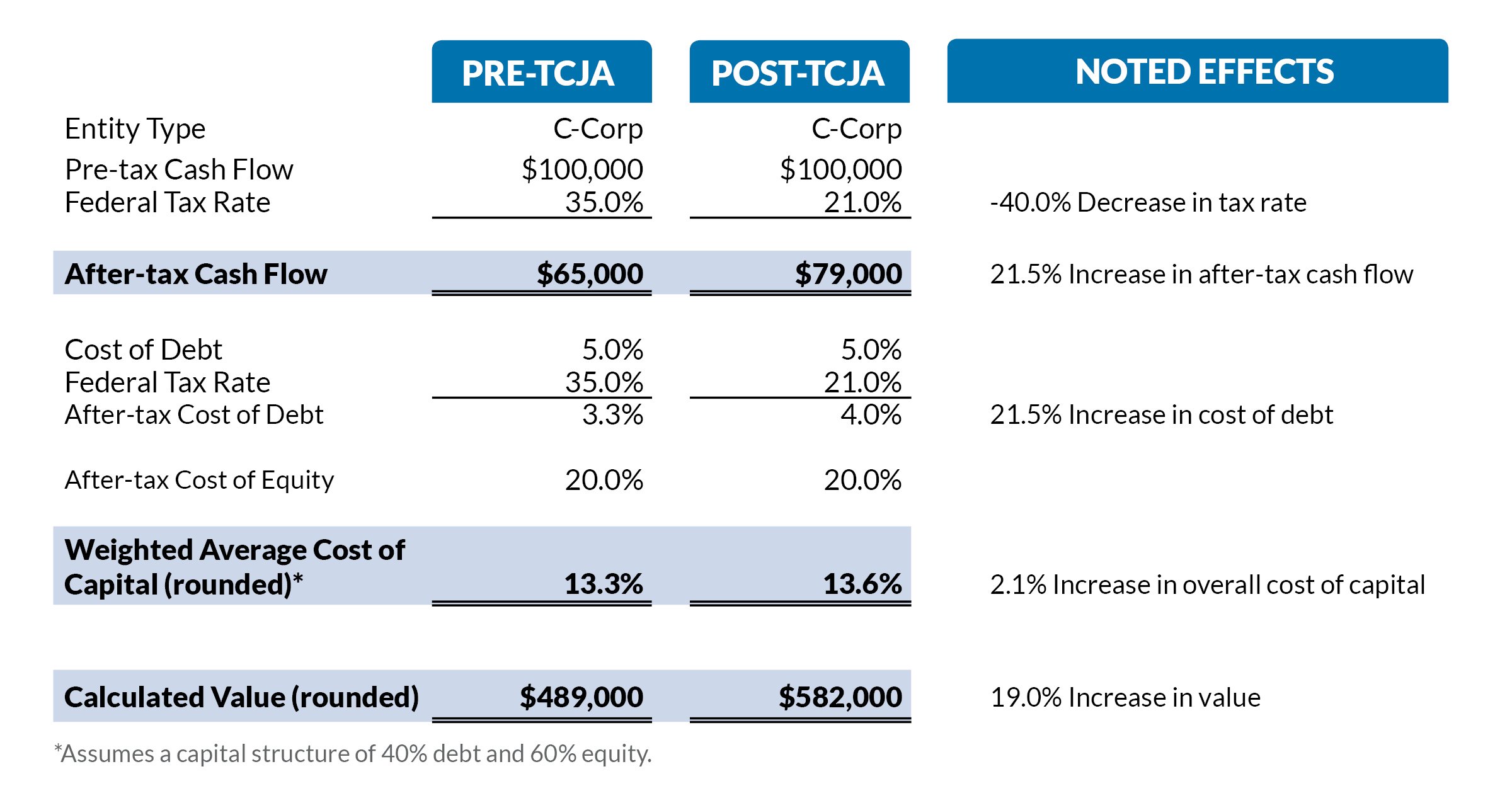

Two of the most fundamental components of business valuation are cash flow (or profitability) and cost of capital (or rate of return). The value of a business is a function of the cash flow it generates to its owners. And, as it relates to cash flow, business owners know that taxes affect the bottom-line profitability of an entity, and most business owners will also know that more profitable businesses are more desirable (valuable). So in general, decreasing taxes for a business will increase profitability and overall value, all else being equal.

The cost of capital is the expected rate of return investors require in order to attract funds to an investment. Most businesses are funded by some combination of debt and equity. Investors (shareholders and debt holders) don’t just give money away for free, though. They expect some form of return on their investment, and that rate of return is generally commensurate with the associated risk of the investment. This rate of return to investors is referred to as the cost of capital. The cost of capital component has an inverse relationship with business value – as a business’ cost of capital increases, its value declines. Here is where changes in tax rates come into play. Because the return paid to debt holders (interest expense) is tax deductible, a business with lower tax rates is provided less of a tax shield, which essentially increases the cost of debt financing, increases the cost of capital and, all things being equal, decreases the value of a business.

How Corporate Tax Rates Impact Business Value

Let’s look at an example of the above scenarios before and after the passage of tax reform.  The examples provide an illustration of how a change in the corporate tax rates can affect the valuation of a business. Pretty simple, right? Unfortunately, the 500-plus pages of new tax code include several other provisions that also alter the valuation landscape. In future posts, we will explore other significant ways tax reform impacts business valuation, including changes related to bonus depreciation, pass through deductions, interest expense and net operating losses.

The examples provide an illustration of how a change in the corporate tax rates can affect the valuation of a business. Pretty simple, right? Unfortunately, the 500-plus pages of new tax code include several other provisions that also alter the valuation landscape. In future posts, we will explore other significant ways tax reform impacts business valuation, including changes related to bonus depreciation, pass through deductions, interest expense and net operating losses.

For more of RKL’s tax reform information and insights, visit our dedicated resource center.