Seven months after the COVID-19 pandemic cast employees and customers out of offices and commercial spaces, the use of physical locations is still limited due to social distancing, capacity restrictions and other virus mitigation strategies. Many businesses are more actively embracing remote work and retail, hospitality and restaurant sectors are shedding locations. While it remains to be seen whether these trends become permanent, there is an immediate financial toll on the commercial real estate industry. This turmoil may provide a silver lining for certain investors through the confluence of depressed value of real estate holdings and all-time high federal estate and gift tax exemptions – let’s take a closer look.

Commercial real estate impact by the numbers

From reduced foot traffic and sales volume to increased health and safety expenses to complete shutdowns, there are a number of COVID-related factors dramatically impacting commercial real estate market performance as a whole. The FTSE Nareit U.S. Real Estate Index, a collection of publicly traded U.S. real estate investment trusts (REITs), declined 11.4 percent year-to-date through August 31, 2020, while the overall S&P index increased 8.3 percent over the same time period.

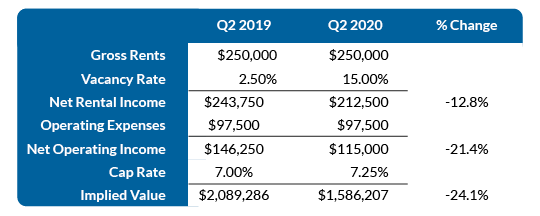

According to the National Association of Realtors® (NAR) Commercial Real Estate Trends & Outlook July 2020 Report, capitalization (cap) rates for commercial real estate have increased for five out of the seven types of commercial properties between the second quarter of 2019 and the second quarter of 2020, as seen in the table below. Cap rates have an inverse relationship with property values; the higher the cap rate, the lower the sale price of a property.

Additionally, the average vacancy rate for all commercial real estate categories has increased, on average, from seven percent in the first quarter of 2020 to 25 percent in the second quarter of 2020, according to the NAR report.

Estate planning opportunity within depressed commercial real estate values

While this may sound like a story of doom and gloom, the depressed value of commercial real estate does open some estate planning and gifting opportunities. Under the Tax Cuts and Jobs Act (TCJA), the federal lifetime gift tax exemption for tax year 2020 is $11.58 million (or $23.16 million for married couples). This exemption will sunset in 2025 (back to $5.49 million) without additional legislative action. As a result, high net worth individuals with considerable commercial real estate assets have a valuable opportunity to remove those assets from their taxable estate and maximize the federal lifetime gift tax exemption.

Here’s an example: imagine a commercial office building with multiple tenants. Fully occupied and rented, this imaginary office space would collect $250,000 in rent annually. Due to the impact of COVID-19, however, the vacancy rate in the office building increased from 2.5 percent in 2019 to 15 percent in 2020. Assuming that operating expenses remained constant, the implied change in value, using the cap rates from the NAR report, is a 24 percent decline in value, as illustrated below.

From an estate planning perspective, this decline in value creates additional mobility for high net worth individuals with commercial real estate assets to reduce their taxable estate and use less of the federal lifetime gift tax exemption when moving these assets out of their estate at a depressed value.

RKL has a team of estate planning and business valuation professionals that can help you take a proactive and efficient approach to preserving wealth during these uncertain times. Contact your RKL advisor or use the form below to start the conversation.